Hub Research Finds an OTT Tipping Point

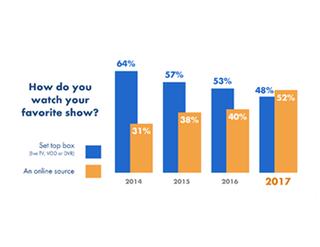

More than half of TV viewers -- 52% -- say they watch their favorite shows online, while 48% watch through an MVPD set-top, according to Hub Entertainment Research's annual "Conquering Content" report, published last week.

Hub said this year marked the first time since it began tracking viewing patterns in 2014 that viewers are "more likely to say they watch a recently discovered favorite show from an online source than through their pay TV set-top box."

The report reinforces last week's Parks Associates study that found viewers favor subscription video-on-demand services over virtual MVPD services.

Related: SVOD Services Still Dominate Paid OTT Landscape

Hub noted that cable/satellite set-top box use has "been steadily declining over the past several years." In 2014, 64% of viewers watched their favorite show via an STB (either live, on a DVR or through the MVPD’s video-on-demand platform). At that time, just 31% said they watched their favorite show online (via an SVOD service such as Netflix, Hulu or Amazon, through a network or MVPD site/app, or through other online sources like iTunes).

The past year saw a 12% jump (from 40% to 52%) in the online viewership preference.

“These findings suggest that the aggressive investment SVODs are making in original and exclusive content is paying big dividends,” said Peter Fondulas, co-author of the study and principal at Hub. “In this research and other recent studies, we see clear evidence that high-profile online exclusives generate buzz that draws consumers to these platform, which not only helps attract brand new subscribers, but also builds loyalty among current customers.”

Hub's Jon Giegengack, co-author of the study, characterized the SVOD companies as transforming themselves "from technology companies that distribute content, into entertainment companies that create it."

Giegengack also observed that the amount of new content "is greater than the disposable time available to watch it." He predicted that in the future, "the share of total TV time may turn out to be a more important way to evaluate platforms than looking at the number of subscribers.”

Hub conducted its research in October among 2,214 U.S. consumers with broadband access who watch at least five hours of TV per week.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.