Viewers Spend Half a Day With Media, But Conflicting Views on 'Where'

Dueling data – that is, research findings that can prove anything you want – have always been one of my media obsessions. So this week’s crop of analytical research offers a bonanza, as well as a contradictory outlook, on how we're watching the cornucopia of viewing options.

An eMarketer study, "U.S. Time Spent with Media," which includes forecasts through 2019, shows that Americans now spend 12 hours and seven minutes per day consuming media, with digital (5:50) and television (4:04) accounting for the overwhelming majority of that time -- often under simultaneous viewing conditions. The eMarketer reports also stressed the growing importance of mobile platforms in the viewing equation, especially among young audiences.

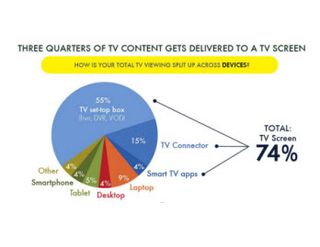

Yet Hub Research's annual “What’s TV Worth” report, which concentrated on the differences between streaming and traditional Pay TV suppliers, concluded that "three-quarters of TV content gets delivered to a TV screen" (see chart, pictured).

"88% of viewers with broadband have a pay TV subscription — statistically unchanged from 90% in 2014," the Hub report said, noting that the two virtual multichannel video program distributors that have been around the longest -- Sling TV and PlayStation Vue -- "each have penetration levels of only 6%."

Although the two studies are not flatly contradictory, their points of view underscore the differences in how they approached the shifting landscape of media consumption.

Hub Research focused on factors to explain why virtual MVPDs, including Netflix and Hulu, have not converted more pay TV viewers to cord-cutters. But Hub acknowledged that the streaming services are finding features that attract broadband customers.

"Part of the big appeal of platforms like Netflix is that they are the 'anti-TV,'" said Jon Giegengack, co-author of Hub's study. "Virtual MVPDs are different from pay TV, but in a more incremental way: They’re still bundles of networks. And their gaps in content or features are enough to keep many consumers from switching from pay TV, even though the price is lower.”

Among Hub's findings is that only 27% of millennials care about watching live TV compared with 51% of overall pay TV viewers who want access to live TV. Perhaps the most significant customer retention finding in Hub's study is that 32% of pay TV viewers cited "access to TV and other services in one account" as a core benefit.

Netflix customers cited "no ads," "easy binge viewing" and "low price" as the top factors that appeal to them, according to Hub Research. And their numbers are growing: In 2015, only 4% of online video subscribers paid for three or more streaming services. Now 32% of streaming customers buy three or more subscriptions.

The Hub study found that U.S. consumers who have broadband service watch at least five hours of TV per week. For pay TV subscribers, 42% of that time is spent with live TV, 17% is DVR viewing, and 14% is for Netflix. Its study of Netflix subscribers found that they spent 27% of their time on Netflix feeds, 26% watching live TV and 13% watching shows via DVRs.

Because of the varying methodologies, it's hard to compare Hub's findings with eMarketer's breakdown, which focused on smartphone usage. Its April research found that smartphone usage for non-voice connections has "steadily increased" and per-day use will reach two hours and 42 minutes in the coming year (up from 2:18 in 2014).

"The proliferation of apps is clearly a factor in this increase," eMarketer said. "More and more of the digital universe is designed to cater to smartphones.

Meanwhile, a separate eMarketer report this week about teenagers' media consumption confirmed that young viewers are increasingly turning to their smartphones for video.

Using Ipsos data, eMarketer found that 71% of teen smartphone users watch TV, movies and videos -- the most widely used feature of the 3+ hours per day they spend with their handsets, substantially more than the number of teens who use messaging (52%), social networking (51%) and games (42%).

“Part of the appeal of smartphone usage for people this age is that the phone is probably the first big-ticket item that has belonged to them personally,” said eMarketer analyst Mark Dolliver. "That’s one more reason why they make the most of the smartphone they have.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.