How to Keep the Mobile Boom Booming

Satellite TV provider Dish Network was the big, surprise winner of wireless spectrum in an auction that garnered surprisingly large, record-breaking sums for the increasingly vital airwaves of the digital economy. The “AWS-3” auction brought in nearly $45 billion, twice the expected total, and did at least four things.

First, it reinforced what we see all around us — the continuing boom in mobile Internet devices, apps, and services. Cisco estimates that North American mobile data traffic in 2014 was 31 times the traffic of 2009, just five years ago. Just a decade ago, pre-iPhone, there was hardly any mobile at all. Yet global mobile traffic in 2014 was 30 times the entire worldwide Internet of 2000. Over the next five years, Cisco expects mobile traffic to grow at an annual rate of 57%.

Second, the auction demonstrated intense competition in the wireless arena. The large sums showed active bidding by lots of parties. And Dish’s audacious move potentially brings a fifth major player into the U.S. wireless market.

Third, the auction proved the value of higher frequency spectrum. In debates over spectrum policy, many have asserted that only spectrum in the 600-800 megahertz range is truly valuable. It’s the “beachfront property,” they say. But the AWS-3 spectrum, situated at a much higher frequency, between 1,695 and 2,180 MHz, brought the highest prices of all time.

Fourth, the surprise results of this auction may in a number of ways affect the more heralded “incentive auction” of broadcast TV spectrum. The incentive auction of the little-used 600 MHz TV spectrum was originally slated for 2015. Even before the AWS-3 auction, however, it was delayed because of complications and objections from broadcasters. The auction could be delayed further as high prices of the AWS-3 auction require time for the industry to recapitalize and as parties argue with the Federal Communications Commission over the bidding rules.

For years, some parties have argued that in order to compete, the FCC should mold the rules to make it more difficult for large players, such as Verizon and AT&T, to acquire more spectrum — and thus make spectrum less expensive and easier to acquire for themselves. You might say this defeats the purpose of an “auction,” yet they successfully placed some of these scale-tilting rules in into the initial incentive auction order. Based on AT&T and Verizon’s winning bids of significant AWS-3 spectrum, they will probably now ask for even more favors in future auctions.

An analysis of the AWS-3 results and the overall spectrum portfolios of mobile providers, however, suggests we should stick with true, unfettered auctions.

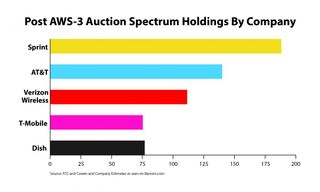

In the just-concluded auction, 31 different entities won spectrum. AT&T won licenses in several expensive big city markets and thus spent the most — $18 billion. But Dish, which today operates satellites not mobile broadband networks, was the second largest bidder, at $13 billion. Dish won far more licenses, covering more of the U.S. population, than anyone. Verizon spent third most, at $10 billion, and T-Mobile was fourth at nearly $2 billion. Sprint did not participate in the AWS-3 auction but still owns more spectrum than any U.S. carrier.

Research by Cowen and Company shows Sprint is far and away the leader in spectrum portfolios among the five largest holders, followed by AT&T and Verizon, and then T-Mobile and Dish. On a per-subscriber basis, the larger two companies, AT&T and Verizon, actually have less spectrum than the smaller firms.

Some have said that the large firms blocked T-Mobile from success in the most recent auction. But the actual bids show that mostly wasn’t the case. For example, T-Mobile was outbid by smaller Dish 132 times but outbid by AT&T just 26 times, and Verizon 16 times.

Beyond these details, it’s important to understand the big picture. Why should special FCC rules block AT&T or Verizon customers from faster data and more services? Other firms may say, hey, we deserve a shot at the spectrum, too. But that’s the purpose of an auction — to encourage the best match of resources and capital. And even more competition is on the way. In addition to Dish’s possible entry, Google says it will launch its own wireless services, built on capacity leased from Sprint and T-Mobile.

The U.S. has the most vibrant mobile Internet marketplace in the world. It’s unlikely the FCC would improve outcomes if it begins divvying up spectrum based on favorites.

Bret Swanson is president of the technology research firm Entropy Economics LLC, a visiting fellow at the American Enterprise Institute, and a U.S. Chamber Foundation scholar.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.