Thoughts on Rupert, Chase and 'Lisbeth: Learning From Mistakes

As good a businessman as Rupert Murdoch has almost always been, like all human beings, there are some clear and lamentable flaws that continue to vex him. These are the kinds of things you would have thought 80 years on this earth, and 65 or so years into the game, would have weeded from his soul, and long ago.

My first true introduction to Rupert Murdoch was in 1995, through his daughter, Elisabeth, when she and her former husband were living in my home town, Carmel, Calif., and working across the hill in Salinas. Because her family had purchased a local NBC station a year or so earlier, Elisabeth Murdoch had taken over the general manager position at the local affiliate, with the call letters KSBW. And because I was so interested in TV and at that time, especially the fledgling Direct Broadcast Satellite industry, and because I knew who her father was, I called her and asked if she and I could meet. Being the lady and the top-class business woman, and class act, that I believe to this day she remains, she said come on over.

The meeting was a good one, I remember. She was quite pleasant, knew her stuff, answered lots of my questions, satisfied my business curiosity, and gave me a much better understanding of - and respect for — a rather complex group of people.

After that meeting in the summer of 1995 (I think that was the timing), I again saw Elisabeth Murdoch at a News Corp. investors meeting in Century City, Calif., where she introduced me briefly to her father as he walked by, and the Murdoch family together introduced the audience of investors at great length to their idea of buying the then newly-created DBS EchoStar corporation from Charlie Ergen. Mr. Murdoch wished to merge Dish Network into what Mr. Murdoch and his News Corp team then called ASkyB. (ASkyB was to be the American equivalent to the Murdoch’s DBS part-ownership play in the U.K., called BSkyB.)

Within a couple of years, however, that News Corp.-Dish deal tanked in litigation (which today sure pleases Charlie Ergen, because of the great things that have happened to Ergen and his companies since), and the Murdochs began their pursuit of another U.S. DBS company, this time the No. 1 competitor to Dish Network, DirecTV. You see Mr. Murdoch has always coveted a prime DBS product and service in North America.

Which is where Chase Carey enters the scene. Chase Carey was, is now, and likely in the future will still be the, or one of the, top lieutenants of Rupert Murdoch globally and in the U.S. of A. When in January 2004, Rupert Murdoch finally fulfilled his life-held dream of owning a top-level U.S. DBS concern, he turned to Chase Carey to take over the reins from DirecTV predecessors Roxanne Austin, as then-president, and then-founder/chairman Eddy Hartenstein, as a DirecTV president before.

I recall writing at one point in 2005 or ‘06 that Chase Carey was not long for DirecTV. I remember that upset one of his press lieutenants at the time. Yet, with his News Corp lineage and his east coast attraction, once Mr. Murdoch decided to sacrifice DirecTV in order to keep News Corp out of the hostile takeover hands of rival Dr. John Malone, Chase was able to quickly fulfill my not-so-tough-to-come-by prophecy. Chase returned to New York City and News Corp., where he soon took over the lead U.S. reigns from former U.S. News Corp. boss, Peter Chernin.

Which brings us full circle to today,

Wed in the greed and the all too much passion to be Number One Above All Others, and not caring enough along the way about what laws are broken or what people are hurt, and we see News Corp. struggling mightily still today against a tide of global disdain for its actions and follow-ups.

And then, when Mr. Murdoch and his team are caught, he refuses to do the right thing: Rather than take responsibility as the leader of the team (which naturally and reciprocally accompanies accepting the opposite, the i.e., the success and the victories…which I’ve often see Mr. Murdoch do), Mr. Murdoch instead blames the others around him who he believes he can sacrifice.

And Mr. Murdoch says they let him down. Yet, again, if long ago they didn’t do something right and it exploded within your own company (which you so ultimately control), then you, Mr. Murdoch, are to blame as much or more for not putting the proper checks and balances in place to catch and correct such behavior, even before it explodes.

And the irony of all ironies: 1) you lost EchoStar to bad management and bad luck; 2) you lost DirecTV to a marketplace struggle to retain your bigger prize, News Corp; and now 3) this recent crisis of bad management causes you to lose your latest bid to completely control BSkyB.

Summarizing, what will you have lost in total, Mr. Murdoch? Well, to start, 1) Some of your personal image as “The Last Media Mogul” (as The Economist recently dubbed you); then 2) your DBS company, BSkyB, in an important part of the world; 3) your esteem built around products like The Wall Street Journal; and 4) your current heir apparent.

But what will you have won? Well, perhaps most importantly, you will have understood who should be the proper person running News Corp post-Rupert Murdoch. Approving settlement payments to victims of hacks, and being accused of not telling the truth before Parliament, do not bode well for continuing respect for your - and your heir apparent’s — futures.

Steve Williams, Tiger Woods’s long time caddy, recently told his old boss, “You will have to earn my respect back.” Well, Mr. Murdoch, even though you are 80, and you probably will not have as much time left as Tiger Woods, I, too, would like to give you the benefit of the doubt. I, too, would like you to earn my respect back. Perhaps you could start by considering picking a better lieutenant than the one who joined you in Parliament recently, and apparently failed to do what he promised, i.e., tell a more accurate story to those asking the questions.

Indeed, if you ask me, I might just have a suggestion. (Hint: Replace JM with EM).

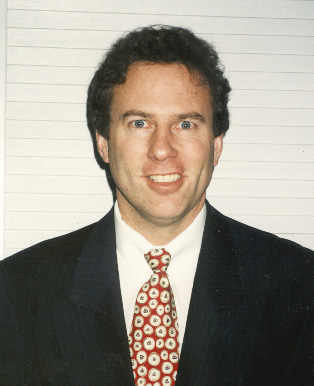

Jimmy Schaeffler is chairman and CSO of Carmel-by-the-Sea-based consultancy The Carmel Group (www.carmelgroup.com).

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Jimmy Schaeffler is chairman and CSO of The Carmel Group, a nearly three-decades-old west coast-based telecom and entertainment consultancy founded in 1995.