Cord-Cutters Mend Their Ways

Cord–cutters, shmord-cutters.

The notion that cord-cutting millennials will erode the cable business into oblivion is being turned on its ear, as cable operators across the board are reporting some of their best video-customer results in nearly a decade and their younger, cooler satellite and telco TV counterparts have encountered mounting losses.

The trend continued last week as Cablevision Systems reported better-than-expected results in third-quarter 2015. Cablevision — which has been a victim of its own success and stepped up promotional efforts by telco Verizon Communications — reported a loss of 33,000 basic-video customers, a 10.5% improvement over the 56,000 video customers it lost in the same period in 2014.

Though customers are still leaving, the erosion has slowed. The results build on those of Comcast, Time Warner Cable and Charter Communications, each of which in the past few weeks reported their best basic-video customer improvements in about a decade.

Comcast was first out of the blocks, reporting on Oct. 27 a third-quarter loss of 48,000 video customers, nearly half of what it shed in the same period last year and its best third-quarter performance in nine years. It was followed by Time Warner Cable, which shed just 7,000 basic-video customers (compared to a loss of 184,000 in the prior year), and Charter Communications, which gained 12,000 basic-video customers, its first increase since the fourth quarter of last year and a big improvement over its 9,000-customer loss in Q3 2014.

CABLE HOLDS ITS OWN

And telco-TV providers are no longer taking up the slack for cable losses. In the third quarter, AT&T — which completed its $48.5 billion purchase of satellite giant DirecTV in July — reported a loss of 92,000 U-verse TV subscribers. At the same time, Verizon Communications said its FiOS TV service added 42,000 customers in the third quarter, one-third of the 114,000 it added in the same period last year.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

The improvements reveal that even in the face of stiff competition (Cablevision has the greatest exposure to Verizon’s FiOS TV product at 49% of its footprint), cable has managed to hold its own.

The trend of cord-cutting — stopping monthly subscriptions to MVPDs — isn’t over by any means. Collectively, all pay TV providers are still losing customers, and most are expected to do the same in the fourth quarter. What’s new is, cable is gaining share in relation to its telco and satellite rivals.

The results have some analysts wondering if they should rethink the whole cord-cutting concept.

“It is time to ask whether we’ve got the story right,” MoffettNathanson principal and senior analyst Craig Moffett wrote in a recent research note.

But not everyone sees a sea change. Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak said AT&T was likely distracted by its merger with DirecTV — satellite-TV provider DirecTV added 26,000 net new customers in the period, compared with a year-ago loss of 28,000 net customers — and should recover in later quarters. And the practice of “cord-shaving,” or migrating to a less-expensive video package, including basic cable, may explain some of the industry’s performance, he said.

From almost the beginning, cord-cutting was seen as a cable problem, Moffett continued, and investors took solace in the fact that MSOs at least had the broadband business to fall back on, if video revenue were to disappear.

Broadband has played a major role, and cable is by far the dominant provider of that service (in the second quarter, cable accounted for 100% of broadband customer additions, only the second time that has ever occurred).

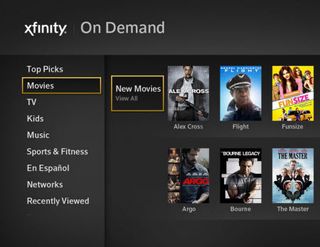

But cable’s relentless focus on expanding its video-on-demand libraries and lineups, enhancing its user interfaces and beefing up its authenticated TV everywhere offerings and apps have also made it and its much maligned video, voice and data bundle into a more attractive choice.

MORE THAN BROADBAND

“Cable is now unmistakably taking share from satellite, and telco TV is fading fast,” Moffett wrote, adding that broadband deserves some credit for the transformation.

“But some of it owes to fundamental changes in the way we are watching TV,” he added. “Cable’s two-way architecture and Comcast’s best-in-class user interface and VOD libraries are emerging as genuine sources of competitive advantage.”

Comcast’s X1 operating system is seen by many as the gold standard for content navigation. At the recent Next TV Summit in New York, Bank of America Merrill Lynch media analyst Jessica Reif Cohen half-jokingly wished that regulators had approved Comcast’s merger with Time Warner Cable just so New Yorkers could finally experience the X1 interface.

And seamless navigation is becoming critical to cable operators’ survival. Clunky text-only, scrolling interfaces offered by many providers are now met with derision by customers who find their smartphones are much more intuitive.

With new sources of traditional shows and short-form content emerging practically every day, finding an elegant way to choose entertainment has become a priority not only for consumers but for the content providers as well.

Last week during the company’s earnings conference call, The Walt Disney Co. chairman and CEO Bob Iger listed his top three essential elements for media success. No. 2, in between high-quality programming and mobility, was creating a “fantastic user experience with incredible interface navigation.”

“You have to make the service easy to use and the content easy to find,” Iger said.

CLOSING THE WINDOWS

Other programmers are getting into the act as well. Last week Time Warner Inc. chairman and CEO Jeff Bewkes said the programmer is evaluating whether to retain its content rights for longer periods or even “forgo or delay certain content licensing,” which would essentially push windows for online subscription video-on-demand services such as Netflix closer to those for syndication.

SVOD licensing generally brings in less revenue than traditional licensing through cable, satellite and telco operators, Bewkes said, and has no advertising revenue attached.

“We think a lot about how to enhance the value of the traditional pay TV bundle and it’s something we’re obviously looking at [with] our networks,” Bewkes said.

In a note to clients, Sanford Bernstein media analyst Todd Juenger praised Time Warner Inc.’s moves, adding that they won’t be effective unless other programmers follow suit.

“It’s also very important, we think, not to just curtail SVOD licensing,” Juenger wrote. “It’s equally important what you choose to do with the content instead. We think the best answer is: Put it on cable/satellite VOD, as part of the bundle.”

The bundle — thought not too long ago to be the reason for high cable prices by forcing customers to pay for channels they don’t watch — is increasingly becoming the more attractive alternative to over-the-top video offerings like Sling TV, Sony’s PlayStation Vue and others. In a research note, RBC Capital Markets media analyst David Bank wrote that when higher charges for standalone broadband service and limited choices for programming are considered, the cable bundle is still the best value.

“A household could save more money forgoing two bottles of wine in a month rather than replacing traditional cable TV with an OTT-based lighter bundle,” Bank wrote.

While Wlodarczak isn’t convinced that cord-cutting or cord-shaving is easing up, he believes cable will continue to improve its results in the fourth quarter. Charter will add about 30,000 video customers in Q4, he predicted, ending the year on a positive note, while Time Warner Cable and Comcast should be flat and Cablevision will lose about 30,000 over the same timeframe.

“I think it is too early to make the call that cordshaving needs to be rethought,” Wlodarczak said. “I think it is here to stay, but as I have noted in the past, I think it will be likely more contained than most media investors seem to be pricing in — one-to two percentage points of decline driven mostly by the fact that pay TV is increasingly too expensive.”

The turnaround in the cable business hasn’t been a one-quarter phenomenon. The turn in the tide for cable-subscriber losses started four years ago, with Comcast in 2011. Since then, the nation’s largest cable operator has reported basic video-subscriber improvements in 14 of the past 15 consecutive quarters, reducing losses by a staggering 83%.

At the same time, No. 2 U.S. operator Time Warner Cable, after a dark period in 2013, has turned around its operations. TWC reported improved basic video subscriber results in the past six consecutive quarters.

Charter, which reported positive quarterly subscriber growth four times in the past two years — 20,000 in Q1 2012; 18,000 in Q1 2014; 3,000 in Q4 2014; and 12,000 in Q3 of this year — is continuing on that path and, along with TWC, has estimated that it will report positive basic-video customer growth this year.

RIVALS TRENDING DOWNWARD

While cable has shown consistent improvement, telcos and satellite providers have been mired in an opposing trend. Once the main growth engines for the pay TV sector, AT&T and Verizon have seen their TV-subscriber growth dwindle in the past two years.

AT&T added 924,000 U-verse TV customers in 2013 and 680,000 in 2014, but in the first nine months of 2015, that growth has dissipated to a loss of 64,000 customers.

Growth at Verizon — which did not close a megamerger this year — has also slowed down. The telco added 536,000 FiOS TV customers in 2013 and 387,000 in 2014. So far this year, the telco has added 158,000 FiOS TV customers.

On the satellite side, Dish Network — which is scheduled to release third-quarter results on Nov. 9 — has struggled with subscriber losses, shedding 79,000 net subscribers in 2014. In the first half of this year, Dish has lost a total of 215,000 net customers.

All of this seems to bode well for the cable industry.

“Cable’s improvement in basic video looks sustainable,” Moffett wrote.