Set-Top VOD Ads Still Play

OTT devices such as Roku boxes, Apple TVs and gaming consoles have become key conduits for digital video advertising, but the traditional set-top box remains a significant player in the overall market.

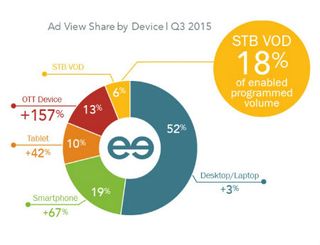

In its Video Monetization Report for Q3 2015, FreeWheel, the multiscreen ad-tech firm acquired by Comcast in March 2014, discovered that the set-top VOD accounted for 18% of total video ad views studied by FreeWheel, making it the second largest device category following desktops and laptops. This report was FreeWheel’s first to incorporate metrics on STB VOD devices.

“To be sure, there is significant scale to be tapped in the STB environment and Publishers and cable/satellite operators are only scratching the surface,” FreeWheel noted. “The volume we see here represents another step towards truly unified, full screen, fully viewable, and fraud-free television.”

The Q3 report from Canoe, the MSO-backed VOD advertising joint venture, amplified those numbers, noting that ad impressions in cable VOD programming jumped 40% versus the year-ago period.

Still, digital video continues to gravitate across a variety of screens. Per FreeWheel, monetization of digital content across platforms outside of desktops and laptops reached nearly 50% of video ad views in Q3, driven by strong growth across OTT devices (up 157%) and smartphones (up 67%).

The study also took another look at TV Everywhere trends, which continue to rise. While ad views from TVE products jumped 242%, authenticated viewing for long-form and live TV accounted for 65% of monetization in Q3, up from 46% in the year-ago quarter, FreeWheel found.

FreeWheel’s report also amplified how different content tends to be consumed on different devices. Viewers watching video on desktops/ laptops and smartphones gravitated to short-form clips (accounting for 59% and 69% of their respective ad views), long-form viewing was most popular on tablets, which saw 43% of ad views coming from shows that were 30-minutes or 60-minutes in length. TV-connected OTT devices, meanwhile, saw 61% of their ad views originate from live TV content, FreeWheel said.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.