Study: Video Streaming Market Shows Signs of Saturation

After riding a solid wave of growth, the U.S. video streaming market is for the first time showing signs of saturation, according to a new study and forecast from Strategy Analytics.

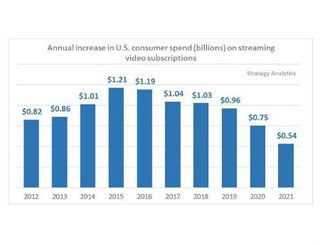

Per the study, U.S. consumers will spend $6.62 billion on video streaming services such as Netflix, Amazon Prime and Hulu this year. While that represents a $1.19 billion (22%) increase compared to 2015, it also marks the first time that the amount spent on those services will be lower than the previous year’s increase of $1.21 billion.

Though that change is relatively small, “its direction is extremely significant,” Michael Goodman, digital media director at Strategy Analytics, said. “It shows that, whilst actual market saturation is a few years off yet, the domestic U.S. streaming subscription market is now on the backside of the adoption curve.”

He expects the incremental increase in annual spending on streaming services will decline from this point on.

Goodman notes that nearly 60% of U.S. broadband homes subscribe to a video streaming service. “We put market saturation at 85% of broadband households – similar to saturation levels for pay TV. Within five years, annual growth will fall below 8%,” he said.

According to Strategy Analytics, Netflix has a commanding 53% of the market, ahead of Amazon Prime Video (25%) and Hulu (13%), and estimates that nearly 40% of U.S. homes subscribing to a video streaming service take at least two.

These signs of saturation in the U.S. market will cause the major OTT SVOD players – Netflix, Amazon, and Hulu – to pursue new growth strategies. Netflix, which already leads the U.S. market, is already pushing ahead with an aggressive global expansion. Amazon has been less aggressive outside the U.S. with its Prime service, but its recent decision to offer a standalone OTT service could pave the way for a broader international move. Hulu sold its Japan business in 2014, but is preparing to launch a multichannel TV service with a slimmed-down lineup aimed at consumers who are not interested in traditional pay TV services.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

While Hulu's plans for a virtual MVPD service will open up a new line of business, Goodman also believes that Hulu will also have to look beyond the U.S. for growth opportunities.

While trends indicate that the larger SVOD players will find growth harder to achieve in the coming years, Goodman believes there’s ample opportunity for complementary, more niche-oriented SVOD services that cost $2 to $5 per month to gain ground in the market.

A prime example, Goodman said, is Seeso, the new comedy service from NBCUniversal Digital Enterprises that costs $3.99 per month.

Since not all streaming service report revenues and subscriber information, Strategy Analytics’ model is based on a mix of public data and survey data. In all, more than 100 lines of code are fed into the model, according to Goodman.

More detail on the study will be featured in the Next TV section of the May 30 edition of Multichannel News.