CSN SportsNet Tips Ad Campaign Against Dish

The battle of words and messaging have escalated in the Comcast SportsNet and Dish carriage contretemps.

Comcast SportsNet last night initiated a multimedia campaign warning that four more of its regional sports networks – Bay Area, California, Mid-Atlantic and Chicago -- may become unavailable to the No. 2 DBS provider’s subscribers early next month. The contracts are slated to expire at the end of Dec. 1, with the RSNs potentially going dark at 12:01 a.m. the next day.

CSN New England, home of the NBA Boston Celtics, has been off of Dish's air since Aug. 1 in a carriage dispute. Charlie Ergen's company has never carried CSN Philadelphia and CSN Northwest, or the recently shuttered CSN Houston. It previously distributed New York Mets-centric SNY, which NBC Sports Group operates and holds a stake in.

On Nov. 20, NBC Sports Group publicly expressed concern that with the expiration of the four RSNs' contracts drawing nigh, Dish has been unwilling to “work toward mutually acceptable terms” for a renewal. In turn, Dish said the RSNs were seeking a 20% increase in monthly license fee for 90% of its customers in the attendant markets, even though the RSNs are only watched by a “small fraction” of the sub bases. The DBS company called this “heavy-handed tactic troubling” in light of Comcast's proposed merger with Time Warner Cable that would give it more power to leverage content in “anticompetitive ways.”

NBCUniversal returned fire saying its asking price is in line with contracted market rates for its RSNs: “We are seeking to license our regional sports networks to Dish on the same terms that other distributors have accepted for this programming. Our rates are reflective of the very high value of this programming, a value that is recognized by consumers through the increased ratings for these RSNs. Collectively, these RSNs present 2,200 live sporting events annually, and live sports account for the vast majority of the highest rated programming in the country. Comcast has nothing to do with this dispute, which is 100 percent created by Dish's unwillingness to negotiate for comparable terms of carriage set by the market. As with Dish's current disputes with Turner and CBS, and its well-established history of unreasonable negotiating tactics that unfairly target consumers, this dispute is not at all impacted by Comcast's pending merger with Time Warner Cable."

NBC Sports Group also pointed out that 96% of its RSNs’ games were watched live, and that CSN Bay Area, home to the World Series champion San Francisco Giants and the NBA Golden State Warrior telecasts, was the highest-rated cable network in San Francisco DMA through the first nine months of 2014 among viewers and adults 18 to 49.

Additionally, it reported significant ratings bumps during the first month of the NBA season versus 2013: 78% for CSN Chicago with Bulls telecasts; 50% for CSN California for Sacramento Kings games; 44% for CSN New England with the Celtics; and 50% and 30% for Mid-Atlantic with Wizards’ action in Baltimore and Washington, D.C., respectively.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

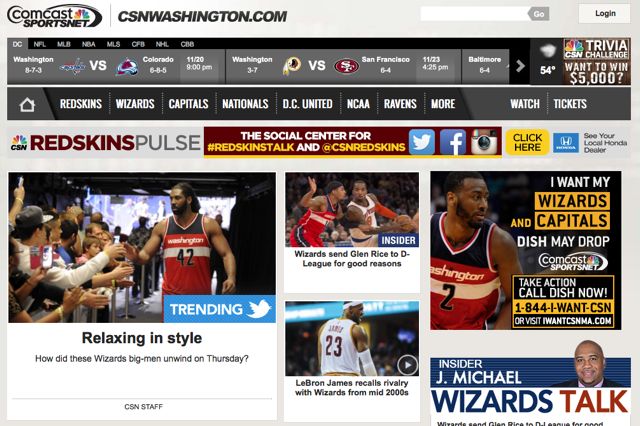

NBC Sports Group also took to the offensive on the RSNs' websites on Nov. 20, asking subscribers to call Dish. A right-column position on CSNMidatlantic.com reads: "I want my Wizards and Capitals and Dish may drop Comcast SportsNet. Take Action. Call Dish Now. 1-888-I-Want-CSN or Visit I Want CSN.com"

Linearly, Dish subscribers began hearing on-air reads and seeing on-air crawls and promos during last night’s schedule. For instance, CSN Chicago is running ads saying: "Attention Dish customers. What if you could no longer watch all your local Bulls, Blackhawks, Sox and Cub games. If Dish drops Comcast SportsNet, that's what's going to happen."

Dish, which in 2010-11 was without CSN California for 10 weeks in a contract dispute, today reached a short-term extension with Turner Broadcasting System to return eight of its networks to the DBS provider’s air and keep TNT and TBS from going dark.

Yesterday, it also reached a contract extension with CBS, whereby the parties are continuing to negotiate toward a renewal for the broadcaster’s owned-and-operated stations and cable properties, including premium service Showtime.