CCAP Market Heats Up: Infonetics

The emerging Converged Cable Access Platform (CCAP) market ended 2013 on a high note as CCAP channel shipments rocketed 192% in the fourth quarter versus the prior period, according to new data from Infonetics Research.

"The pent-up demand for new CCAP-capable equipment is evident in the early volume deployments of CCAP gear, and we expect the upward trend in combined CMTS and CCAP channel shipments to continue as operators prepare their networks for DOCSIS 3.1 and potential remote PHY (physical layer) architectures," Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research, said in a statement.

CCAP, now a CableLabs spec, is a dense, power- and space-saving architecture that combines the functions of the cable modem termination system (CMTS) and edge QAM and puts all cable services under one roof. Arris, Cisco Systems, Casa Systems, CommScope and Harmonic are all chasing the initial phase of the market. Gainspeed, a startup launched by DOCSIS pioneer and Terayon Communication Systems co-founder Shlomo Rakib, is trying to take the lead with a "virtualized" CCAP that distributes the functions on the network controlled by a centralized software platform.

The bump in CCAP shipments translated into an 11% revenue increase in the fourth quarter for the combined CCAP, CMTS and edge QAM market, but it wasn’t enough to take it over the top. Infonetics said the combined global market for this product category declined 8% in 2013, dropping to $1.3 billion versus the prior year. He attributed that shortfall to CMTS channel price erosion that reared its head in the early part of 2013.

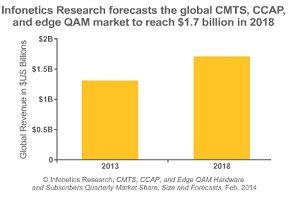

Infonetics now forecasts that the global CMTS, CCAP and edge QAM market will rise to $1.7 billion in 2018, representing a five-year compound annual growth rate of 5%.

Huge quarter for Casa Systems

Among individual vendors, Casa Systems turned in an “outstanding fourth quarter” with CCAP shipments worldwide, though it wasn’t enough to unseat perennial leaders, Cisco Systems and Arris. “However, these vendors should now be on notice, as Casa's made inroads and will continue to make this market more dynamic,” Heynen said.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Casa made a huge leap in the quarter, according to a closer look at the numbers. In an interview, Heynen said Casa’s share of CMTS/CCAP revenues in the period rose to 23%, blowing out the 4% it pulled in during the third quarter of 2013.

Cisco, with 44% of CMTS/CCAP revenues in the fourth quarter, held the top spot, but that was well off the 60% of the market it commanded in the third quarter. Arris, meanwhile, represented 33% of the market in Q4, just off the 35% it held in the previous quarter.

Heynen said Casa has been getting a boost from its position with Time Warner Cable alongside solid momentum in Europe and in the Asia Pacific region. While it would appear that Casa is gaining at the expense of Cisco, Heynen suggested that Casa might also be winning some share in markets that have historically used CMTS gear from Motorola (Arris bought Motorola Home last April).

Without a lot of organic growth to come by for these vendors, “it’s all about share gain and share loss,” Heynen said.

And time will tell if Casa will be able to sustain the momentum, or if its fourth quarter surge was simply a "blip" caused by operators flushing their fourth quarter budgets, Heynen said.

Harmonic, meanwhile, maintained its top position among edge QAM vendors in 2013.