Old Controversies and New Businesses

Related > Viewer Watch 2017: Download the Complete Report

Though TV has long been a numbers game, hard data showing changes in the way consumers access video remains a hotly debated subject.

It’s not just that there’s considerable disagreement over how to interpret these changes among executives overseeing what Magna calls the $67 billion TV ad market and PwC describes as the $101 billion subscription pay TV business. There is also much grumbling over the kind of data that is available to answer these multibillion-dollar questions.

“I don’t think we’ve made as much progress as we should have made” in measuring the consumption of video on all platforms and devices, Turner Broadcasting System chief research officer Howard Shimmel said.

There also isn’t much agreement on how the growth in multiplatform video consumption will affect pay TV subscriptions. Some contend that the rise of over-the-top streaming options will sharply reduce the pay TV subscriber ranks; others believe the issue is much more complex.

“From its peak in the first quarter of 2012, the major providers have lost about 1.8 million subscribers,” Bruce Leichtman, president and principal analyst at Leichtman Research Group, said. “The industry is clearly saturated and in a slow decline.”

Interpreting those numbers remains controversial, in part because data on the size of the pay TV universe rests on different assumptions. Leichtman, for example, includes data from services like Sling TV in his company’s estimates, while SNL Kagan does not.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Nielsen also provides different numbers. It reports the number of homes that have TVs connected to a pay TV service, which is different than the number of total pay TV subscribers reported by operators, Nielsen executive vice president of research Glenn Enoch said.

“You have to be very careful about the numbers you use and [about] drawing a straight line from those numbers to revenue, because things are much more complicated than that,” he said.

Related > New Normal: Digital Distribution

CORD-CUTTING CALCULUS

A number of researchers agreed. The proportion of “people dropping pay TV subscriptions is now about 2.6%,” Leichtman noted, which is about the same rate as 10 years ago, when the industry was growing.

“The problem is that the number of new customers has declined,” Leichtman said. “We only see 1% [of homes] moving into pay TV. That is down from 3.5% a decade ago and it has had a real impact on the dynamics of the pay TV industry.”

The declines have been smaller than some had expected, SNL Kagan research director Ian Olgeirson noted. “We are seeing a slight acceleration in the decline in subscribers for multichannel services from a roughly 1% decline in 2015 to a decline of what will probably be 1.3% or 1.4% in 2016,” he said.

The causes of those declines are also hotly debated. “Service providers would say that a lot of those declines are driven by price” and economics, Olgeirson said. But that isn’t the whole story, as the economy has rebounded and housing starts have grown over the past two years, he said.

A recent Frank N. Magid Assoicates survey found that 75% of likely cord-cutters said the ability to watch content via the Internet and OTT platforms was a key reason to drop pay TV service, Magid Advisors president Mike Vorhaus said. Only 29% of respondents cited costs.

Research also challenges the prevailing assumption that pay TV and SVOD services are competing offerings, said Howard Horowitz, president and founder of Horowitz Research, who sees them as complementary to traditional pay TV.

Horowitz survey data shows that 52% of whites and 58% of Hispanics have both a multichannel subscription and a subscription VOD service, while only 5% of whites and 6% of Hispanics have just a SVOD service.

STAGNANT AD SPENDING

Much unease also surrounds the ad market. Brian Wieser, senior research analyst, advertising at Pivotal Research Group, said the economy faces considerable uncertainty over the next year.

“I don’t think anyone can say with any certainty what is going to happen next and that uncertainty is going to curtail advertising,” he said.

National TV ad revenue will drop slightly by 0.4% in 2017 to $44.6 billion, Wieser predicted, and remain essentially flat through 2020, when it will hit $45.2 billion.

Magna’s Letang also sees a weak TV ad market combined with bullish prospects for digital media. “In 2017, we see high single digital inflation [in pricing] but high single-digit declines in ratings,” Letang said. “National TV will be up 1% in 2017 from 2016 if you exclude P&O” — meaning the 2016 revenue from political ads and the Summer Olympics — “and down 1% if you include P&O.”

With political and Olympics spending included, Magna projects that total TV spending will drop by 4.8% to $64.2 billion in 2017, declining further to about $62.2 billion in 2021.

Digital spending, though, will continue to grow rapidly. By 2020, Magna forecasts that mobile advertising will more than double to $78.4 billion (38.2% of all advertising) and social media will hit $31.8 billion in 2020 (a 15.5% share). TV, meanwhile, will slip to a 32.4% share.

Given the uncertainty over the ad market and pay TV subscriptions, programmers and operators have been rethinking their operations.

NEED TO BE NIMBLE

The drive to adapt to new consumer habits has prompted a number of projects to make operations more nimble, Discovery Communications chief technology officer John Honeycutt said.

For example, Discovery’s recently deployed “On Ramp” project allows about 80% of the content produced by 600 production suppliers to be uploaded to the Amazon cloud, where it can be immediately available to Discovery employees and channels all around the world.

“Going from 0% to 80% makes us so much more flexible and efficient,” Honeycutt said.

Equally dramatic upgrades are occurring in the pay TV infrastructure. After ticking off a long list of new products and initiatives to deliver more content to more devices, Comcast Cable executive vice president, general manager, video and entertainment services Matthew Strauss noted that these efforts are built on major improvements to the MSO’s infrastructure.

“We are rolling out DOCSIS 3.1,” he said. “We are rolling out Gigabit speeds. We are transitioning more and more to all-IP, which will allow us to innovate and deliver more of these newer services.”

Rapid innovation has also become the norm for digital platforms. “In 2016, we launched 30 new products and made hundreds of enhancements on dozens of platforms,” Alex Wellen, senior vice president and chief product officer at CNN, said.

Much remains to be done, particularly in the area of measurement. This year will mark a notable improvement on that front, with Nielsen planning to begin syndicating its Total Content Ratings on March 1.

“But some of the networks have been saying they won’t be ready for Nielsen’s public rollout in March, and it isn’t clear if everything will be ready in time for the upfronts,” Jane Clarke, CEO and managing director of the Coalition for Innovative Media Measurement (CIMM), said. “It is a very complex process to get it implemented in the apps for every kind of player and all the devices.”

Others worry about the TV industry’s ability to maintain its share of ad spending without better data. “Measuring crossplatform video consumption is important, but it is a 2006 problem,” Turner’s Shimmel said. “Today, when we talk to advertisers, what they really care about is outcomes [such as sales] and I don’t see that kind of measurement anywhere in Nielsen or comScore’s future.”

More debates surround commonly held perceptions of the OTT market.

Michael Leszega, senior analyst of market intelligence at Magna, said that “in 2016, we have [more than] 25 million cord-cutters and cord-nevers,” and that this group will continue to grow. By 2020, he predicted, about 28.6% of all households will be outside the traditional pay TV ecosystem. “It is a sizable portion of the population that can’t be ignored,” he said.

That has prompted a number of companies to develop streaming bundles of channels like Dish Network’s Sling TV, Hulu, Sony’s PlayStation Vue and AT&T’s DirecTV Now.

“If you look at the rumors about Amazon or YouTube coming out with OTT bundles, there could be a whole bunch of them, maybe seven or eight by the end of 2017,” Steve Shannon, general manager of content and services at Roku, said.

Tony Goncalves, senior vice president of strategy and business development for AT&T Entertainment Group, described DirecTV Now “as a mobile-first-centric platform” that will deliver the kind of advanced digital features consumers expect from their mobile apps.

“DirecTV Now is pay TV as an app and it opens up a market that has not historically been addressed by pay TV,” he said.

Dish Network also sees great promise in the melding of pay TV packages, OTT delivery and app experiences, Niraj Desai, the company’s vice president of product management, said.

“TV is becoming an app,” he said. “We have been talking about that trend for a while, but 2016 was really the year TV as an app came into its own” with better TV everywhere offerings and the streaming OTT bundles such as Dish’s Sling TV and DirecTV Now.

COMPLEMENTARY PLAYS

Even better, these products open up new markets and are not designed to cannibalize traditional pay TV offerings, he added. “Sling is complementary to DBS,” he said, meaning Dish and DirecTV’s satellite-TV platforms. “Sling over-indexes with urban millennials and DBS resonates with suburban and more rural customers that are more traditional TV watchers.”

Similar views come from programmers that have aggressively targeted consumers without traditional multichannel TV subscriptions.

“We launched HBO Now with the theory that its subscribers were going to look very different from the traditional subscribers,” Bernadette Aulestia, executive vice president of worldwide distribution at HBO, said of the premium programmer’s standalone app.

HBO Now subscribers are 10 years younger than customers of HBO’s premium cable network and typically live in broadband-only households, she said.

“We look at it as an entry point to customers that are coming into the category,” Aulestia said.

The growing popularity of skinny bundles and streaming OTT offerings has also helped HBO’s premium pay TV business, she added.

“There was a time, as a premium service, that we were only sold at the top of the bundle,” Aulestia said. “The idea that HBO should be sold at every level of the bundle, and even as a standalone service, means there are fewer barriers to get HBO.”

The rise of OTT and skinny bundles has been more worrying for ad-supported networks.

“Getting more creative packaging of content to create more customized solutions for the consumer can be very challenging for content providers because you have increasingly fragmented audiences,” Joe Atkinson, technology, infocomm, entertainment and media advisory leader at consultancy PwC, said.

Atkinson and others said OTT distribution can also open up a number of new opportunities.

For instance, the growing SVOD market encouraged Turner’s recent launch of an OTT movie service called FilmStruck, Coleman Breland, president of Turner Content Distribution and president of TCM, said.

“As the bundle became tighter, we decided to go direct to consumer instead of trying to launch a linear network and push it through the ecosystem,” which would be difficult in the current pay TV environment, he said.

Turner has also been pushing to expand the content made available on all platforms both in terms of reach and quantity, with the addition of offerings like full seasons on-demand.

“We now have 450 affiliate partners for our TV everywhere products” and have seen usage jump by “triple digits” in the last year, Breland said.

TIME TO TARGET

Many of these newer products can be traced to a more fundamental change in the way operators think about their customers.

“Today, service providers have to figure out how to target different individuals in household,” PwC’s Atkinson said. “That is a tough challenge, but I think it is really the keys to the kingdom.”

One example of such a targeting effort is the development of packages targeted to consumers at different life stages. “College students have different needs than a single-family home with kids, and we are very focused on meeting all those different needs,” Comcast’s Strauss said. He said the Xfinity on Campus product has been a success in that regard.

Operators have also been greatly expanding the content sources via apps on Internet connected set-top devices such as Dish Network’s Hopper. “You can watch live TV with your Dish subscription, or recorded TV on your DVR or you can watch Netflix and YouTube all in one convenient place,” Dish’s Desai said.

Adding more choices has also been a top priority for Cox Communications, Steve Necessary, executive vice president of product development and management at the Atlanta-based cable operator, said. “We have more than doubled our VOD offerings from 50,000 to over 120,000,” he said.

Cox also has revamped its TV app to expand the content available on digital devices and speeded up the rollout of Contour — Cox’s version of the Comcast X1 Internet-connected set-top platform — from 3,000 customers to more than 600,000 in 2016.

Very importantly, such efforts are also beginning to pay off. Both Comcast and Cox are seeing some of their best video-subscriber efforts in a decade.

Programmers are also reporting strong gains from their digital platforms.

“There is a blending of content types and expansion of the platforms,” translating into some record-setting numbers, ESPN vice president of digital media research and analytics Dave Coletti said.

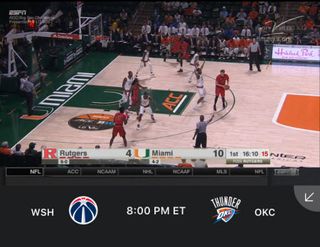

In year when some live sports audiences have declined, Coletti noted that Watch ESPN’s live stream of the Nov. 26 college-football game between third-ranked Michigan and second-ranked Ohio State — which went into double overtime before OSU prevailed, 30-27 — tallied 1,273,000 unique viewers, making it ESPN’s most streamed regular college football game. (The game telecast also aired on ABC.)

“Eight of our top 10 most-streamed regular season college football games have occurred this year,” he noted.

The 2016 presidential election helped CNN set a number of network records, Wellen said, including a record audience level on Nov. 9 with 77 million unique users, 83 million video starts, 483 million page views and 29 million live streams.

Equally notable was social media. CNN racked up 169.7 million video views on Facebook and 47.6 million Facebook Live views, he said.

“Those results show that it has become very important to be both a destination for content and a distributed brand,” he said. “We have apps and websites where people can access our content but, we’ve also seen that we can be very successful on Facebook Live” and other outside platforms.

Additional encouraging news can be found in TV use, Nielsen’s Enoch said. “The decreases that we saw in TV usage that really started to accelerate in the mid-2014 have lessened,” he said. “TV consumption remains at near record level.”

“We are also seeing a shift back to the more traditional way of hooking up a TV” to a pay TV service or an antenna, he added. “The universe of homes that can watch TV or can stream video to the big screen has actually grown,” reversing a trend that began with the digital transition and the 2008 recession.

That said, Enoch said the “fastest growing area of overall usage — not just video — is the smartphone.”

In the second quarter of 2016, Nielsen reports that consumers ages 18-34 spent almost as much time each week with their smartphones (14 hours and 36 minutes) and tablets (three hours and 27 minutes) as they did with traditional TV (18 hours and 27 minutes).

Less discussed but equally important are connected TVs. “TVs connected to the Internet by any device have grown from about one-quarter of all households in 2010 to about two-thirds of all households,” Leichtman said. “There are now more connected TV devices in American than there are pay TV set-top boxes.”

Said CBS Interactive president and chief operating officer Marc DeBevoise, “We are seeing explosive usage in those connected TV experiences.” He added that “time spent on connected TVs with our products has grown by more than 300%.”

As an illustration, consumers in October of 2016 spent about 347 minutes per month consuming CBS news content via desktop computers, compared with 360 minutes via Apple TV and 496 minutes via Roku, per unique viewer, DeBevoise noted.

“That is a lot of usage, and we are spending a lot of time making certain we can capitalize on that by getting those experiences right,” he added.

LINES ARE BLURRING

Connected TVs also offer much more advanced capabilities for search and discovery. For example, the Roku platform allows users to search for TV shows and movies across more than 100 apps, Roku general manager of content and services Steve Shannon said.

Advanced features are helping to blur the line between connected devices, pay TV operators and the new bundles of streaming channels.

Companies such as Hulu and Sling are increasingly bundling their subscription packages of channels with a free Roku, Shannon said. Also, Charter, Comcast and a number of other operators have either launched or plan to launch TV everywhere apps on the Roku platform so that subscribers can access a large bouquet of channels on the pay TV apps, he said.

“You have the normalization of OTT, where you are seeing massive amounts of traditional broadcast style content viewing on OTT platforms,” Shannon said.