Rising Cable One Stock About to Hit a Wall

Cable One stock, the top performer in the distribution sector in 2016, took a slight dip out of the stratosphere after influential media analyst Craig Moffett lowered his rating on shares to “sell” — with a $408 target price. The cable operator, riding a wave of hefty price increases and plummeting programming costs, is about to hit a wall, in Moffett’s view.

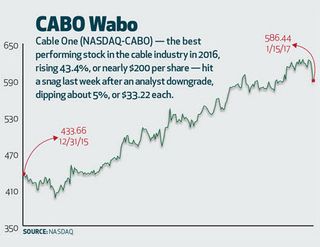

Cable One shares declined about 5% ($33.22), going from $619.66 on Jan.3 to $586.44 on Jan. 5, the day after Moffett’s report came out.

It all underscores the stock’s remarkable rise. Cable One stock rose 43.4% in 2016 — or nearly $200 per share — ascending from $433.66 to $621.73 at year’s end, pumped up by speculation that it would be the next takeover target in the consolidation wave after Charter Communication’s $80 billion acquisition of Time Warner Cable.

European telecom company Altice N.V., which spent more than $25 billion on purchasing Suddenlink Communications and Cablevision Systems in the past year, has been singled out as the most likely Cable One buyer, although private equity and other smaller players could enter the fray too.

IRRATIONAL EXUBERANCE?

Moffett said that while it might seem strange to downgrade CableOne’s stock right around the time that Altice is expected to spin off a minority interest in its U.S. operations — Altice USA — to the public, he believes the takeover premium has been long baked into Cable One’s stock price.

What concerns Moffett and other analysts is how Cable One has been able to maintain its growth trajectory as customer growth has eroded rapidly.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Cable One embarked on a broadband-only strategy in 2012. The midsized operator has taken a hardline stance against rising programming costs, dropping Viacom’s networks in 2014, and instead has focused on high-speed data service, offering speeds of up to 1 Gigabit per second in some markets.

But with lower costs — programming expenses dropped 10% in 2014, its first year without Viacom — have come heavy subscriber losses. Cable One shed 20% of its video customer base in 2015 (about 87,000 subscribers) and while those numbers have improved — it lost 13.5% of its video base in Q3 2016 — they are still well above those of the operator’s peers.

Overall, the pay TV market is losing video customers each year. But cable has been improving on its losses and could post its first positive growth year in a decade in 2016.

Cable One has said publicly that its strategy is unorthodox, but it believes it is on the right path.

“While this strategy runs contrary to conventional wisdom in the cable industry, which puts heavy emphasis on video customer counts and maximizing the number of PSUs [primary service units] per customer by bundling services, we believe it best positions us for long-term success,” Cable One said in its 2015 annual report. “For us, success in winning and retaining residential data and business services customers are far more important metrics than the number of triple-play customers we have.”

So far the approach appears to have paid off. Cable One has maintained steady revenue and double-digit percentage increases in cash flow in 2014 and 2015, and is expected to have another strong year in 2016. And though Moffett commended the company for its performance so far, he also said he believes that time may be running out.

Moffett said “more than all” of Cable One’s growth has been due to price increases; it imposed a hefty 10% hike to broadband charges in 2015 and it’s on the verge of having to increase fees again to a customer base that is, overall, the least affluent compared to the customer groups served by other top MSOs.

“We don’t project that Cable One’s EBITDA will actually decline in 2017, but we do project that EBITDA is about to hit a wall,” Moffett wrote, adding that the expected deceleration comes at a time when the stock is trading a premium multiple (11.7 times cash flow) to its competitors.

A PRICE TOO HIGH?

Moffett conceded the high multiple is largely due to takeout speculation, but he also noted that it is not only higher than the multiples of much bigger companies (Comcast trades at 7.6 times and Charter at 9.9 times) but outpaces the premiums paid for Cablevision (10.1 times) and Suddenlink (10 times) by more than a full turn of cash flow.

Cable One’s strategy also may throw a wrench into the one thing that most investors have bought the stock for: a potential acquisition. Moffett notes that falling subscriber rolls mean less opportunity for a potential buyer.

“Even if de-emphasizing video was the right decision for Cable One on a standalone basis, any potential acquirer would naturally view Cable One’s video subscribers through the lens of their own programming costs, not Cable One’s,” Moffett wrote. “By shedding so many video subscribers, Cable One has foregone a tremendous amount of potential synergy for an acquirer.”