Tech Winners, Losers in Charter’s M&A Play

As Charter Communications’ proposed acquisitions of Time Warner Cable and Bright House Networks move forward (see Cover Story), expect the angst among suppliers to build as they position themselves for the outcome.

Some could find themselves on the outside looking in, while others are firmly in the catbird’s seat. For still others, notably Arris, it presents a mixed bag.

The future is not set, of course, but here’s a snapshot of some potential winners and losers from the deal.

CABLE MODEMS/ROUTERS/GATEWAYS

Winners: SMC Networks, Cisco Systems, Netgear

On the residential end, SMC Networks and Cisco Systems are Charter’s primary suppliers of cable modems, sources have said. Netgear, meanwhile, has locked in a slot to supply Charter subs with WiFi routers, including a new high-octane model that uses 802.11ac outfitted with Charter-specific middleware.

A dark horse winner in this category is French supplier Sagemcom, said to have Charter’s gateway business for smaller business customers and to be gearing up for an aggressive residential play.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Losers: Arris, Technicolor and Ubee Interactive

These three vendors are the approved gateway suppliers for TWC’s residential broadband service, so their hold could loosen should Charter apply a modem-plus-router strategy while continuing to eschew the use of integrated wireless cable modem gateways.

SET-TOP BOXES

Winners: Cisco, Humax

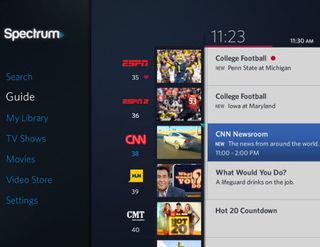

They are the initial suppliers of the Worldbox, Charter’s new set-top box platform that will support cloud-based apps, including the MSO’s new Spectrum Guide, and a new downloadable security system that will enable the device to run on any Charter system.

Possible Losers: Humax, Samsung and Arris

Humax finds itself in both camps, because it has also been tapped to supply TWC with its first set-top client based on the Reference Design Kit, the software stack for Internet prototcol-capable devices being managed by Comcast, Liberty Global and TWC. Charter has not divulged any specific plans for the RDK, at least not yet (expect something on this in next week’s issue).

Samsung is a known supplier to TWC and Bright House, but has not announced anything involving Charter’s Worldbox program. However, it does supply boxes to Cablevision Systems that utilize the same “open” architecture that Charter is using in its Worldbox platform.

Arris has been supplying TWC with a souped-up six-tuner “enhanced” DVR for the MSO’s “TWC Maxx” upgrade initiative. It’s not yet known how those rollouts will continue once Charter expands its Worldbox strategy.

MISCELLANEOUS VIDEO TECH

Winners: Cisco, Arris, ActiveVideo and Zodiac Interactive

They’re all involved in the video end of Charter’s Spectrum initiative, Cisco (downloadable security), Zodiac (set-top software stack), and ActiveVideo (user interface cloud TV platform), which is now co-owned by Arris and Charter.

Also sitting pretty is Michael Willner-led Penthera, which last week announced deals to supply its secure video-downloading platform to Charter and TWC, while reupping its agreement with Comcast.

Time Will Tell: Envivio

Envivio has bet a lot of chips on TWC. On last week’s first-quarter earnings call, the multiscreen video specialist said it received significant orders from Comcast and TWC, and that those two customers represented 57% of revenue in the period.

BILLING AND CUSTOMER CARE

Winner: CSG Systems

It’s coming off a new deal with Charter that’s good through the end of 2019, and includes a framework that, presciently, allows for the consolidation of additional customers that Charter might obtain through M&A activity. CSG also has existing deals with TWC and BHN.