Covid-19: Short-Term and Long-Term Impact on the Cable Industry

It is hard to believe, but the entire world is grinding to a halt as more and more communities are forced into lockdown or shutdown to prevent the spread of the Coronavirus. In this bleak and difficult situation, the Internet has emerged as the nervous system of the world, keeping education, business, healthcare and people connected as never before. It is not that people have suddenly discovered the online world, far from it; however, in the space of a few weeks, the world has converted to eLearning, telemedicine, virtual meetings, virtual conferences, and so on. Even religious and arts institutions are streaming to their constituents and the public at large, not to mention the increase in streaming and gaming now that most people are confined to their homes. In February, Cisco saw 22 times the amount of network traffic per second it normally gets for WebEx, according to CNBC. It is likely to be even higher in March.

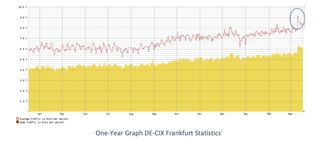

None of these use cases are new, but they have all of a sudden been adopted on a massive scale. Early reports from Europe suggest a 40% increase in network traffic. Can networks handle this amount of traffic?

To be sure, many of these trends are short term, driven by necessity; for example, schools are repeatedly making clear that eLearning is a short-term measure and is not a substitute to in-person education. Furthermore, the success of these online initiatives requires much more than fast and reliable broadband; at a minimum, they need to be complemented by new processes, appropriate resources, clear expectations, training, and a different IT infrastructure, among other things. However, it is likely that things will not necessarily revert to business as usual when the crisis has passed.

What is clear is that in the near term, the world needs a lot more broadband and needs it to be fast, reliable and affordable. To their credit, ISPs have stepped up to the task. They are removing consumption caps, increasing speed, providing free bandwidth to the under-privileged, and committing their resources to keep broadband networks reliable and functioning in this moment of great need.

Do cable operators have the capacity to meet the exploding demand in the access network in terms of speed, reliability and latency? It is true that the industry has largely wrapped up the deployment of DOCSIS 3.1, which delivers speeds up to 10 Gbps downstream, and operators have been continuously reducing the size of their service groups by splitting nodes. However, the unprecedented demand on their networks may require a new playbook, because this surge may stay with us for a while, and some of the increased usage will prevail for the longer term.

Will this surge in demand be the catalyst for the industry to seriously consider migrating to the distributed access architecture (DAA) on a large scale? Will this need to suddenly increase capacity become a driver to consider virtualized solutions that enable easier scaling in the headends? Will it drive operators to allocate more capacity to upstream?

The cable access network remains limited in the upstream: most operators still allocate only 42 MHz to upstream with a minority allocating 84 MHz. Upstream capacity will become crucial as more people rely on virtual meetings, eLearning, etc. The industry has a good upstream option with the 204 MHz split that is currently supported (as an option) in the DOCSIS 3.1 specifications and that is made available by most major industry vendors. The 204 MHz split can enable 1 to 1.5 Gbps upstream. Of course, there is no free lunch; more spectrum allocated to the upstream means less in the downstream, and there is a need for a guard band or “spectral penalty” of about 54 MHz. The migration to 204 MHz requires changes to existing nodes and amplifiers on the HFC plant.

Multiple operators are already trialing or deploying DAA, particularly the Remote PHY version, and some have already adopted virtualized solutions. It is entirely possible that this trend will gain momentum driven by market need.

It is too early to tell what the long-term implications of this crisis will be. What is certain is that it will not be business as usual when we are finally out of crisis mode, and for broadband providers, it might spur a new cycle of infrastructure investment.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Guest blog author Liliane Offredo-Zreik is a principal analyst at ACG Research, where she is responsible for cable access infrastructure market research and consulting practice. Offredo-Zreik is also president and founder of boutique advisory firm The Sannine Group.