Five Challenges for the IP Video Era

IPTV is radically changing the way that content gets consumed by giving TV viewers greater control over the entertainment they want to watch.

This rate of disruption is driven by the emergence of new consumer experiences, new distribution options for content, new devices, new competitors, new sectors in the ecosystem and new content sources and creators. Here are the top five challenges that pay TV operators need to surmount to thrive in the rapidly evolving IPTV landscape.

Streaming services are raising user expectations

Over-the-top (OTT) services like Netflix have changed the game. Consumers today have far different—and far more diverse—expectations when it comes to entertainment content.

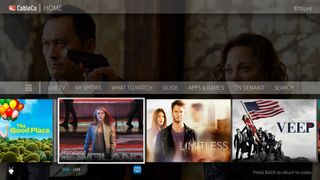

Consumers have greater exposure to a range of OTT/web-based content, and that is influencing their perception of innovation and raising the bar for every player in the industry. They don’t only expect their pay TV service to provide a channel guide and the ability to search for their favorite shows. They also expect greater personalization and discovery. They expect their pay TV service to learn their tastes and continuously provide innovative new features and next-generation discovery options that allow them to connect quickly to content they like.

Traditional pay TV operators need to respond if they want to hold onto existing customers, minimize churn and attract new ones. The good news is that pay TV operators are uniquely positioned to solve an increasingly chaotic entertainment experience for consumers by leveraging their strengths in live and recorded/VOD content availability, bringing OTT and pay-TV offerings together and upgrading to next-gen, cloud-based solutions that up the pace of innovation.

Conversational voice interfaces are going mainstream

Voice interaction is entering the mainstream as tech giants like Google, Amazon and Apple heavily promote voice-based features and drive consumer adoption. Consumers can now speak to their devices and actually be understood with accuracy and reliability. This is driving pay TV operators to look very closely at their own voice-based interfaces and how they can extend them to consumers.

If done right, voice offers the optimal user experience for not only command and control but content discovery and navigation. It not only helps users get to their content faster but also enables operators to expose users to a much greater breadth of content. For example, voice enables operators to offer a highly personalized, highly conversational interface capable of addressing complex queries such as, “Show me popular sitcoms from the ’90s, available on Netflix.” The ideal offering for operators is one that combines a deeply media vertical content solution with the broader voice ecosystems of Google, Alexa, Siri, etc.

Operators are embracing Android TV and unmanaged devices

Not long ago, Android TV was a controversial topic among pay-TV operators. But not anymore, now that Google has been continuously listening to operators and addressing the majority of their concerns.

Today, Android TV is highly attractive to operators for a number of reasons. In addition to being able to address a wide range of devices that consumers can access content on, the OTT ecosystem available through Google Play brings together thousands of apps that operators can instantly tie into. However, as the content grows, so does the need for a superior, differentiated and consistent user experience flowing across all client platforms and backed by a powerful cloud service that’s flexible, agile and scalable.

RELATED: TiVo Goes Device-Agnostic with New Platform for MVPDs

What’s more, with Android TV’s Operator Tier, Google has addressed concerns around security and control. Specifically, operators now have full control over operator experience and boot screen, as well as the ability to tie into Google Assistant and Google Play. As a result, Android TV offers another viable option for operators who may be looking at ways to integrate its offerings into their overall strategy.

Cable operators are starting the transition to IPTV

As operators look to IPTV, they’re encouraged by new and unique revenue opportunities, such as the ability to provide more OTT-like services to certain market segments.

But many operators wonder how they can they transition from their current infrastructure to IPTV, while controlling costs and minimizing disruption to users. Some operators will manage the transition more seamlessly and cost-effectively than others and that will make a significant competitive difference.

The reality is that the right next-gen solution can provide versatile deployment options—from QAM to hybrid to full IPTV. Such a solution can assist operators in their transition to IPTV by maintaining support for QAM deployments, while still offering a flexible migration path by addressing the capital expenditure, networking and rights constraints of the operator. As a result, operators can address their most strategic concerns while quickly adapting to the evolving needs of customers.

Dynamic features and partnerships are rising in importance

These days, new enterainment features pop up all the time, and pay-TV operators need to be evaluating their services on a daily and weekly basis, rather than quarterly or annually. But, it takes a great deal of agility and flexibility to capture customers in today’s dynamic, hypercompetitive marketplace – how can you stay ahead?

The best way is by leveraging a cloud service that gives operators the flexibility to anticipate market needs or consumer trends, as well as the robust ability to roll out quickly across all device platforms.

They should also form more partnerships. Savvy operators are starting to bundle OTT services like Netflix with their own offerings because such partnerships open up new opportunities for them. In fact, in a market that is increasingly fragmented, there is a window for providers to serve as the starting point for consumers’ entertainment experience and guide them through the maze of content options. It’s no longer a deal-breaker if the operator must hand off the consumer to a partner service. The goal is to own the race track, not the individual horses.

In the days, months and years ahead, IPTV will become an increasingly important part of the broadcast landscape. Operators that look beyond their traditional business model and embrace emerging IPTV opportunities will be the big winners going forward.

-- Michael Hawkey is senior vice president and general manager, user experience, TiVo

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.