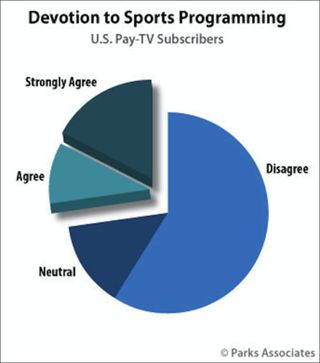

More Than a Quarter of Pay TV Customers Subscribe for Sports

A new Parks Associates study that found 27% of pay TV homes say "sports programming is the primary reason" they subscribe comes at a time when sports content is preparing for a distribution overhaul.

Parks' figures fall toward the high end of the long-held range of households that watch televised sports on a regular basis -- about 15% to 30%, depending on which research study you believe. Subscribers' appetite for sports may be encouraging to cable executives -- for now.

Operators have often cited the modest viewing levels to fend off high-priced sports packages, although as the Parks study affirmed, devoted sports fans buy whatever it takes to see their preferred programming. And that's where the looming appeal of streaming enters the picture.

Brett Sappington, Parks' senior director of research, cited the shifting trends in sports carriage.

"While broadcast and pay TV remain key sources for live sports, OTT streaming options have become an important part of the live sports landscape," Sappington said. "Increasingly, leagues and networks are offering direct-to-consumer options. These services offer access to content that would otherwise not be broadcast and subscription options to those not subscribing to pay TV."

He pointed out that CBS and ESPN recently launched their own streaming services for sports content, and noted that these services will "both compete with and complement major services such as WWE Network and MLB.TV."

Related: CBS Sports HQ Service Hits the OTT Field | One Small Step for ESPN+

Sappington predicted that "over time, pay TV providers will likely partner with these types of services in order to round out their existing channel packages."

Migration Already Underway

One indicator of the shift to different platforms is the paucity of baseball games on over-the-air broadcast channels -- making it impossible for fans, for example, in Washington, D.C., to see games of the nearby Baltimore Orioles or for Los Angeles viewers to see any games without a pay TV subscription.

This year, only 199 Major League Baseball games will air on broadcast channels, compared with 338 games in 2013, according to data compiled by John Mansell, an independent sports business analyst. That means only 4.3% of local games appear on OTA TV; five years ago it was 7.3% of games. Mansell's data show that regional cable sports networks are carrying 4,420 baseball games this year compared with 4,270 games five years ago.

Just as broadcast TV -- once a staple of local sports fans -- has shifted to cable, there are many indicators of sports' looming move to streaming platforms. But that move is not without challenges.

"What's happened now for cable is extremely predictable," said a former sports network executive who requested anonymity.

"If technology takes us to streaming, then the programs will go there," he added, calling it "the evolution of the economics."

"If streaming becomes the way we consume media, then the rights will go there," he said.

Viewing habits are changing, especially among millennials, who are already a problematic audience for sports producers and distributors. The leagues and some individual teams that control media rights to games are looking deeply at streaming options. In some cases, the streaming rights (for now) are bundled with cable rights, although that connection is likely to be a major negotiating point in future contacts, according to lawyers who are involved with the process.

Major League Baseball's emergence as a leading streaming technology provider (using tech it developed for its own MLB Network) is an indicator of the emphasis that sports producers are placing on the potential of that distribution platform, which eliminates the middleman (conventional networks).

Amazon last month nabbed the U.S. Open Tennis championship streaming telecasts in the United Kingdom for the next five years, a deal which analysts believe is the opening volley in Amazon's next wave of sports deals. Amazon's package will include live coverage plus on-demand highlights and other enhanced features.

Related: Greenfield Says Amazon Poised to be Most Disruptive Tech Giant

Social media platforms are also accelerating their sports programming line-ups. For example, Twitter recently unveiled plans with Disney's ESPN to create live sports programming and other content, including carriage of SportsCenter Live, with viewer participation. Twitter will also live-steam ESPN's fantasy sports podcast.

Related: 'SportsCenter' Expanding on ESPN’s New App

Facebook began live-streaming baseball games on its MLB Live page in March, carrying about one game per week. Although usage data so far is not available, a report this week indicated that latency glitches have annoyed viewers: 34% would cancel a service if they encountered such technical problems, the study found.

Twitter recently published its own research to show advertisers that the social media platform "makes live sporting events more engaging and memorable." The study emphasized fans' experience during live events when they use Twitter "as their second — and primary — screen to learn what’s happening in real time."

The study, which used comScore data, showed an average 4.1% lift in unique visitors during sportscasts, and the "difference is even more pronounced with tentpole sports events" such as the Super Bowl or other championship games.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.