Pandemic Broadband: It's Working

Mark Radabaugh owns and operates Amplex, an 8,500-subscriber competitive broadband provider/operator. Amplex is headquartered in a rural residential area just west and south of the western end of Lake Erie, in – we love this! – Luckey, Ohio.

Recently, as part of a renewal project to research and write a report for Radabaugh's broadband industry trade group, the Wireless Internet Service Providers Association (WISPA), the author interviewed a handful representing several dozen of the industry's top fiber and wireless competitive broadband distributors. Only in small part because he is a member of the WISPA board of directors, that esteemed grouping includes Mr. Radabaugh.

One of the more topical and interesting observations Radabaugh provided -- together with another competitive broadband distributor, plus one of the industry's largest equipment providers -- was on how well competitive broadband systems like his were faring. This query becomes especially topical in light of our country's battle against the coronavirus, known as COVID-19. Put another way, with so much bandwidth usage shifting from outside and inside U.S. businesses and anchor institutions, to inside and around homes, How are the nation's competitive broadband distributors holding up? Also, importantly, this means, How are the subscribers of those operators holding up?

Ample Networks

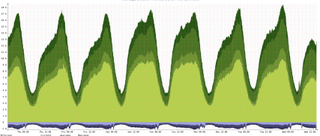

Amplex provided the chart below. It shows the collective use of bandwidth from March 6, 2020, to March 19, 2020, by its subscribers. All of the green is downstream (i.e., that coming from the internet to subscribers), while the blue and purple below the straight horizontal line in the chart is traffic from the customer.

Radabaugh makes the following observations:

- Changes in the downstream flow of bandwidth are small compared to the upstream changes.

- Yet, that said, the upstream changes are maybe not where most would expect them to be, considering the radical changes in lifestyle in the Time of Pandemic.

- Daily peaks in usage occur nightly around 10 p.m.; lowest usage occurs around 5 a.m.

- Typical of any day is Monday, March 9, 2020: morning traffic rises and levels off around 8 a.m. Around 2:30 p.m., traffic use rises tied to children returning from school and logging onto the internet from devices at home. That usage climbs steadily until around 10 p.m.; and the cycle repeats.

- Tuesday, March 10, 2020, was the day Xbox announced a new release of its “Call of Duty” video game. That event creates the higher traffic that continues through Wednesday, March 11, 2020.

- By Saturday, March 14, 2020, the influence of stay at home recommendations and other guidance appears to have clicked in, as much heavier daytime and overall use is evident.

- Monday, March 16, 2020, shows about double the normal daytime traffic.

- By Tuesday, March 17, 2020, it is clear that more people are working at home, including students.

- The last two days on the chart above, Wednesday, March 18, 2020 and Thursday, March 19, 2020, are probably the new normal traffic levels, at least for weeks to come, in this Age of The 2020 Pandemic.

“The network has no problems handling the increase," said Radabaugh. "It has to be able to handle the peak traffic – which it does – not the average traffic. It's like a highway: if you build it to handle rush hour traffic, and it does so without congestion during rush hour, then at 5 p.m. it doesn't matter at all if the traffic at noontime is twice the normal noontime average. It's still well below rush hour.”

Relatedly, much recent talk and messaging around providing all of America with broadband, turns on the message that in order to satisfy the majority of customers' broadband needs, each subscriber needs to receive upwards of a gigabit (or more) of bandwidth. The reality, according to the experts above, below, and elsewhere, and according to recent observations of customer usage, is ample operation of broadband networks using far less bandwidth.

In fact, most subscribers don't use anywhere near the bandwidth they pay for. This means a lot of unnecessary dollars go into broadband providers' accounts, to pay for bandwidth that is not used.

Indeed, as Radabaugh's fellow broadband operator, Jeff Kohler, co-founder and chief development officer of Englewood-Colorado-based Rise Broadband, has said for years, “25 megabits per second (Mbps) can deliver an awful lot of video. 100 Mbps is wasted on most customers.”

Bigger POV

Depending upon your perspective, Rise Broadband is both large and small. Compared to Comcast's nearly 25 million subscribers, Rise is a small ISP. Yet, compared with the average size, approaching 1,500 subscribers, of a U.S. competitive broadband provider, Rise is way larger and many times over. Thus, whenever data from Rise Broadband is accessible, it is typically worth noting.

Rise Broadband reported that:

- As of late March 2020, total bandwidth usage among Rise's subscribers is up, at least 10%.

- Noteworthy, though, is that new usage is not happening during the core evening, “prime time” viewing hours, of roughly 6 p.m.-10 p.m.

- Instead, an increase is occurring during the “non-busy hours,” with more kids and folks using internet during the day, outside of typical usage patterns.

- Rise expected its peak hours to increase 5-10%, but that hasn't yet been seen in the data.

- As for 4K usage, it's not something Rise worries much about. Streaming codecs are so good these days, that based on capacity, content delivery will seamlessly scale without the vast majority of viewers ever noticing.

- Worth repeating, Rise finds that increasing customer premise speed rarely yields any difference in usage, yet customers are often lured into buying higher speeds -- that go unused -- by cable and fiber providers.

Vendor POV

Cambium Networks, housed in Rolling Meadows, Illinois, has also noted the recent spikes in the bandwidth carried by its antenna and radio equipment that is focused on the nation's fixed wireless providers. Its director of product management, Matt Mangriotis, pointed out that traditional traffic in the business realm occurs during the daytime hours of 8 a.m.-5 p.m. The typical business use is as much up as down, and typical residential use occurs in the early-to-mid evening hours of 6 p.m.-12 a.m., he said. Home use is tied strongly to typical over-the-top (OTT) downloads from providers like Netflix and Hulu.

Nonetheless, during the pandemic, Cambium has seen its operator clients report business subscriber use has declined. Meanwhile, residential use all day long has gone up, in some instances and with some subscribers as much as 60% in overall use. “The peak is all day long,” Mangriotis adds. He also understands that more of his ISP partners are getting calls from subscribers to increase the quality of their packages, and asking for more types of services to subscribe to.

Cable and broadcast research entity ComScore predicts big increases, as well.

Other articles grappled with the same (or a similar) message:

- Comscore: US In-Home Data Usage Surges

- HBO Now Streaming Has Ballooned 40% in Past Week, WarnerMedia Says

- How the COVID-19 Coronavirus Pandemic Is Impacting Rural America

- How Broadband Inequality Complicates COVID-19 School Closures in Rural Areas

- Daytime Video Streaming Up 40% During COVID-19 Crisis: Conviva

- Comcast Claims Video-on-Demand Is Hitting Record Highs

Proper Bandwidth Messaging

Ultimately, today's competitive broadband distributors appear to have the spectrum, the equipment, and the resultant bandwidth to more than amply supply the basic needs of 25 Megabits per second (Mbps) downstream and 3 Mbps upstream, a speed ratio that is quite adequate for the vast majority of broadband users in America today. Moreover, fiber access by every user is a long ways away from being a required element, in order to obtain quality video and data service, even if such a thing were less pricey than it is today. Finally, for the vast majority of users, fixed wireless requirements of more than 25/3 are a long ways away from becoming a value, which stands a good chance of being a more important message, for some time to come.

All of this is another way of saying that guys like Mark Radabaugh (and their subscribers) have a lot working for them. That's because their networks appear quite capable of adequately serving most rural and other subscribers. And because of that network resiliency -- despite our current coronavirus dilemma -- it's a good time to be lucky, especially carrying broadband to today's and tomorrow's rural America.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Jimmy Schaeffler is chairman and CSO of The Carmel Group, a nearly three-decades-old west coast-based telecom and entertainment consultancy founded in 1995.