Pay TV Pandemonium: Cable, Satellite and Telco Get Shotgunned

To borrow a line from a recent client study conducted by The Carmel Group, “If the prior video industry changes described above were sorted, they would each be no more than mere silver bullets, whereas the current TV revolution is comparable to a shotgun blast, in that huge numbers and hugely powerful sets of stakeholders are being directly and significantly affected at every turn during this crisis of change.”

What we were writing about was a comparison of prior video industry transitions, seven in particular: 1) radio, to B & W TV, to 2) color TV, to 3) cable TV, to 4) satellite TV, to 5) an analog-to-digital transition, to 6) bundled services, and to 7) telco subscription TV.

And to be clear, the current transition or set of changes we talked about there, and that we talk about here in the form of “pandemonium” is none other than the Internet and Over-The-Top distributors and their ability to slowly or quickly replace the world of pay TV video distribution that we take for granted today. And it will.

Because, as noted in a prior “Mixed Signals” column from four weeks ago entitled “New Plays For Old Stakeholders,” huge tectonic plates are in the process of shifting the video world as we once knew it. Indeed, the Genie is out of the bottle, in the form of consumers being introduced to and demanding that all-important driver-trend, choice.

Yet, when we think about the shotgun analogy, it’s important to note that the content owners and the pay TV operators are not facing hundreds of tiny pellets approaching their corporate bodies at hundreds of miles per hour. And even if they were, those corpus corporata have such deep pockets and so much to lose, that you can bet the really smart folks who run those places are going to proceed with great caution and prudence to keep that serious damage from ever happening. Indeed, witness some of Jeff Bewkes’ recent comments on behalf of one of the biggest Pay TV and content duos, Time Warner.

But what I question is how much real control they can ultimately exert over that ultimate change.

Which is to say there are now so many video choices, both from the programming production and the programming distribution sides, that unless the traditionalists take risks to completely alter their business models in light of this change, they may have no choice but to go the way of the bow and arrow themselves.

Noted one well-known and experienced and really smart executive among the 50 recently interviewed for this and other articles, “Five to ten years from now, the players making the most money will be different from those of today.”

And that is the most interesting balancing act. Put another way, how do you shore up and hang onto the great deal you have, while also looking ahead toward — and trying to control — the future that you also may not have? It’s almost as scary (and pandemonium producing) as facing a real shotgun, and not knowing whether it’s loaded (or not), or who’s pulling the trigger (or not).

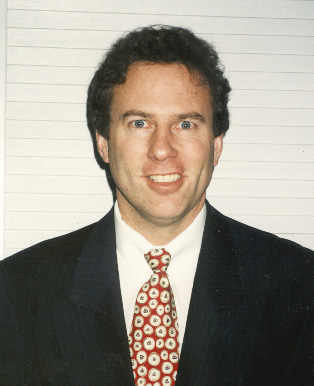

Jimmy Schaeffler is chairman and CSO of Carmel-by-the-Sea-based consultancyThe Carmel Group.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Jimmy Schaeffler is chairman and CSO of The Carmel Group, a nearly three-decades-old west coast-based telecom and entertainment consultancy founded in 1995.