Verizon, AT&T Subs Most Apt to Switch to Xfinity Mobile: Study

As Comcast flirts with 600,000 customer lines for its year-old Xfinity Mobile service, the bulk of them are coming way of Verizon Wireless and AT&T, according to a new study.

RELATED: Comcast Adds 197K Xfinity Mobile Customer Lines in Q1

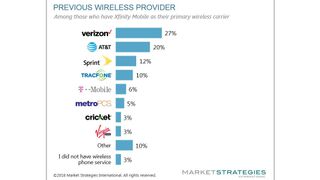

Among consumers who now use Xfinity Mobile as their primary mobile carrier, 27% are former Verizon Wireless customers, and 20% came from AT&T, versus just 12% from Sprint, MarketStrategies International found in a study focused on what the firm calls the “Xfinity Mobile Effect.”

The study was based on an online survey of 1,044 adults conducted in March that included Xfinity Mobile customers, Comcast customers without Xfinity Mobile, and non-Comcast customers. Data was weighted to reflect current wireless carrier market share.

Xfinity Mobile leans on an MVNO deal with Verizon Wireless and tied into Comcast’s WiFi network. Comcast added 197,000 Xfinity Mobile customer lines in Q1 2018, ending the period with 577,000. Charter Communications plans to launch Spectrum Mobile, a service that also relies on a Verizon MVNO deal, by mid-2018.

RELATED: Charter Eyes June 30 Debut for Spectrum Mobile: Report

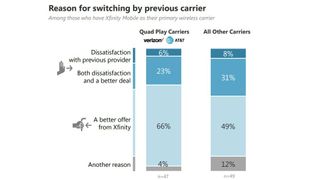

As for drivers for those who did switch to Xfinity Mobile, 75% of the total said overall plan costs was the largest, compared to data costs and the use of WiFi hotspots to save on data usage and costs (38% each), and 28% cited free talk and text on up to five lines.

More detail about the study and Comcast’s mobile offering, including how it is faring in the early going from a Net Promoter Score perspective, will be featured in the May 7 issue of MultichannelNews.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.