Altice Losses No Cause for Alarm

Altice USA investors headed for the exits after the New York-area cable company said it would likely report negative broadband customer additions in the fourth quarter, a potential sign of weakness in cable’s long-standing dominance in the high-speed data market. That looks like it might be an overreaction.

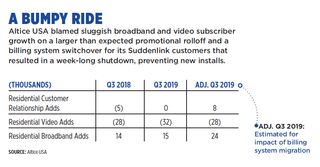

Shares in Altice USA, a top performer in the sector (up 90% between Dec. 31, 2018 and Nov. 5, 2019), fell more than 20% on Nov. 6 after the statement about losing broadband customers in the fourth quarter. The Optimum and Suddenlink parent also reported flat revenue and cash-flow growth in the period and reduced full-year revenue growth guidance to 2.5% from 3% to 3.5%.

Cable stocks have enjoyed some of their most robust growth in the past 18 months, rising about 40% in 2018, due to broadband’s potency. It seemed like the industry had finally shaken the albatross of video customer losses (about 3 million in the past three years) that have consistently dragged on shares.

Broadband Is the Driver

Broadband is key to the future of the cable industry. Any glitch in that status, no matter how small or short-term, has an impact. Despite the recent introduction of wireless services by Comcast, Charter Communications and Altice, those products are largely seen as retention tools. It’s not like Wall Street believes the cable business has anything to fall back on.

In a research note, MoffettNathanson principal and senior analyst Craig Moffett said though several factors may have led to the cable sector rally, three could derail it: slower unit growth, slower pricing growth and the threat of new regulation.

“The results reported today [Nov. 6] play to both of the first two fears,” Moffett wrote. “With the stock up this much, it is tempting to say that these risks are now more urgent, and to argue that investors had become complacent.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

While growth was “perilously slow” in some areas, Moffett added, that was more due to pricing.

“The warning about higher churn in Q4 due to promotional rolloffs will only heighten anxiety, as it speaks to unit growth deceleration, which may be the greater concern,” Moffett wrote.

Altice USA CEO Dexter Goei said he expected broadband additions to get back on track in 2020, blaming the expected Q4 losses on the expiration of promotional offerings and the conversion of some Suddenlink customers to a new billing system that shut down some systems for a week, preventing the new installations.

“It just happens to be that we’re hitting a vortex of a lot of the promos rolling off in the second half of this year,” Altice USA CEO Dexter Goei said during the earnings conference call with analysts.

Altice stock fell as much as 22% on Nov. 6, before closing at $25.98, down 17%.

The rest of the sector was relatively stable. Charter dipped about 1% on Nov. 6 and Comcast was about even for the day, down 6 cents per share to $44.22.

Comcast added 373,000 broadband customers in Q3, its best Q3 growth in a decade, while Charter’s 351,000 broadband additions solidly outperformed the prior year’s 266,000 adds in the period.

Leichtman Research Group president Bruce Leichtman said the Altice guidance shouldn’t have a big effect on the overall broadband market, with big gains at Comcast and Charter in Q3 pointing to continued growth.

“Take it with a grain of salt,” Leichtman said of the Altice guidance. Despite high penetration rates for cable broadband, the industry has a proven success rate in attracting customers in new housing builds.

“New home builds represent another million houses per year, and they [cable] are getting all of it,” Leichtman said.

Altice USA didn’t say how many broadband customers it expected to lose, just that it will lose some. Other analysts, like Evercore ISI’s James Ratcliffe, who had earlier expected Q4 additions to be in the 20,000 subscriber range, now pegs the Q4 broadband loss at about 5,000 subscribers.

No Shift in Fundamentals

“We don’t see this as changing the fundamental long-term trend of 1-2% broadband subscriber growth, roughly in line with household formation,” Ratcliffe said in a research note.

Sanford Bernstein media analyst Peter Supino wrote that Altice USA’s aggressive growth strategy, an ongoing fiber-to-the-home build and the prospects for mobile service gains outweigh any short-term challenges. He predicted “improving fundamentals for years to come.”

Strong operational fundamentals had made Altice USA one of cable’s favorite stocks, praised for aggressively pricing mobile and video offerings. In addition to pricing its Altice Mobile service at $20 per month for existing video and/or data customers, Altice launched a price-for-life campaign for video and data customers that would lock in pricing for as long as the customer stayed with the service.

On a conference call with reporters before the analyst call, Goei said because of heavier than expected promotional expirations in Q4 Altice anticipates “heavy” disconnects of service. He said subscriber numbers should return to normal subsequently and one of the motivations behind the price-for-life campaign was to mitigate against declines in the future.

“As we start replacing promotional rolloffs with price for life, that will continue to abate,” Goei said. “The real goal of price for life is to drive less customer interaction and have people feel a lot better about their product and not getting some very large step-ups in pricing once they come off promotionals.”