Around 40% of U.S. Pay TV Ecosystem Up for Grabs?

Cord cutting is at a tipping point, with 23% of SVOD users now 55 and older, and pay TV operators now officially done with subsidizing unprofitable customers through aggressive promotions.

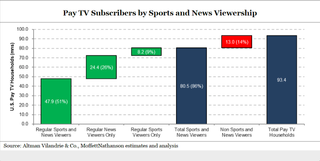

According to MoffettNathanson analyst Michael Nathanson, around 40% of the remaining pay TV ecosystem is exposed to cord cutting.

Nathanson surmises that about 60% of the 93.4 million pay TV homes in the U.S. contain regular sports viewers. And as long as major sports leagues continue to tie their key rights to the U.S. pay TV ecosystem, these viewers will provide a “potential floor” to the market.

Nathanson made his comments in a report highlighting his firm’s recent “Fall Summit on Cord-Cutting and the Future of Video.”

Nathanson bases his conclusions on data supplied by research company Altman Vilandrie & Company. His findings suggest that 85% of remaining pay TV subscribers are regular sports and news viewers. However, it’s the “sports” portion of that audience remains “the most entrenched pay TV subscribers, Nathanson suggests.

AT&T Now Going Bye Bye?

Meanwhile, with AT&T currently rolling out a full-featured virtual pay TV bundle that’s priced less than its legacy AT&T TV Now streaming service, Nathanson said the telecom is “essentially exiting" the vMVPD business.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Formerly known as DirecTV Now, AT&T’s three-year-old vMVPD has been in obvious decline, finishing the third quarter with 1.145 million remaining subscribers. This was down from a high of 1.809 million users at the end of the second quarter of 2018.

AT&T has stopped offering promotions like free OTT players for AT&T Now signups. It’s also no longer giving away the service to subscribers to unlimited wireless and other AT&T products.

Most tellingly, however, AT&T is slowly rolling out AT&T TV, which is a full featured streaming pay TV service, undercutting the AT&T TV Now with a $60 entry-level price point that delivers 73 channels and 500 hours of cloud DVR storage, as well as a free Android TV-based OTT device.

AT&T Now delivers only around 45 channels for a monthly price that has risen to $65.

Related: AT&T TV ‘Pilot’ Launch Expanded to Four More Markets

The marginalization of the once vital AT&T Now service comes as another notable player in the vMVPD business, Sony PlayStation Vue, prepares to exit the market in January.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!