AT&T-TW Deal or No Deal, Land Rush Will Go On

Critics of AT&T’s pending $108.7 billion purchase of Time Warner have pointed to the myriad dangers of consolidating large content and distribution companies – but some analysts say the environment is already headed in that direction.

The U.S. Dept. of Justice has already said it would block the AT&T-Time Warner merger, with the parties scheduled to go to court to state their cases on March 19. Whatever the outcome, the rush for scale won’t be slowed, UBS Securities telecom analyst John Hodulik said.

Related: Feds Lay Out Court Strategy for Blocking AT&T-Time Warner

Hodulik — who believes the deal will be approved — cited in a research note the steady decline of traditional TV distributors, the accelerated push for heft and the inevitable move to direct-to-consumer services as catalysts for more deals. Subscribers to traditional pay TV providers have declined by about 50% since 2010 and dipped 14% in 2017 alone, he noted.

OTT Has Changed Everything

“OTT is clearly the future of video distribution,” Hodulik wrote, and is likely the main driver behind the mega content deal between The Walt Disney Co. and 21st Century Fox, Comcast’s unsolicited bid for British satellite TV company Sky and CBS’s moves to revisit a recombination with corporate sister Viacom.

Hodulik argued that government fears that a combined AT&T-Time Warner would limit content choices and drive up prices run counter to the OTT-inspired shift. And if AT&T isn’t allowed to purchase Time Warner, another company will.

Earlier this month, at an industry conference, CBS chief operating officer Joe Ianniello called the current environment an “arms race” to accumulate content needed to drive direct-to-consumer products.

Ianniello said CBS All Access, the broadcaster’s own OTT product, will add six to seven new shows in the next 12 months, just to compete with the likes of Netflix and other providers. “We’re doubling down,” he said.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

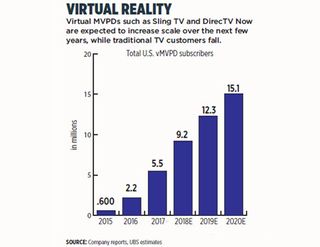

Hodulik thinks the land rush for content is warranted. He predicted that virtual multichannel video programming distributors such as Sling TV and DirecTV now will nearly triple their subscriber bases from about 5.5 million in 2017 to 15.1 million by 2020.

Watch MCN: vMVPDs by the Numbers

At the same time, pay TV subscribers, down 3.6% in 2017 to 95.4 million customers when vMVPDs are included, are expected to dip another 4.4% in 2018 to 91.2 million, according to the analyst.

Cable Gets Into the Act

Hodulik said traditional distributors dipping their toes in the vMVPD waters — like Comcast and Charter Communications — will make the full plunge in the next few years.

Comcast introduced Instant TV in late September, a package of broadcast and education channels for $18 per month, to compete with Sling TV and DirecTV.

Charter unveiled its “Choice” package — 25 channels for $21.99 per month — earlier this year.

Mostly because of a desire not to cannibalize existing, higher margin businesses, the offerings haven’t been broadly offered. That is about to change, especially as streaming services gain scale, Hodulik believes. He said he thinks it won’t be long before their OTT offerings mirror their existing video packages.

“We believe scale benefits will eventually lead cable to offer streaming TV services out of region, likely in conjunction with a wireless offering,” he wrote.