Broadcasters, Nets Brace For Sports Fee Surge

Sports rights are expected to go higher in the next three years despite pressure from COVID-19, possibly driving increased retransmission-consent fees and pushing poorer homes out of the pay TV bundle.

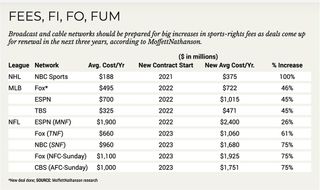

The National Football League, Major League Baseball and the National Hockey League will have national TV-rights deals up for renewal in the next three years. The National Basketball Association, which suspended its season in March due to the COVID-19 pandemic, doesn’t come up for renewal until 2024. Some are trying to find ways to salvage their postponed seasons, such as MLB games in Arizona in empty stadiums. And most are expected to get big increases, according to MoffettNathanson media analyst Michael Nathanson.

The NHL also suspended its regular season in March. The NFL, which doesn’t start its season until September, hasn’t made any decision regarding suspensions, and most are hopeful the lockdowns currently associated with the COVID-19 outbreak will be lifted before then.

A Spike in NFL Rights

So it shouldn’t be any surprise that Nathanson believes the NFL will have the biggest increases in rights fees — as much as 75% for Sunday games aired by the three broadcast networks (NBC, CBS and Fox) when they come up for renewal in 2022, he wrote.

The NFL has renegotiated its collective bargaining agreement with the NFL Players Association, agreeing to increase players’ share of revenue from 47% to a minimum of 48% beginning in 2021. At the same time, the league has increased the number of regularseason games to 17 from 16 and changed its playoff format. The league will now send seven teams to the playoffs, up from the previous six.

The extra games should boost league fees come renewal time. In a separate research report, Barclays Global media analyst Kannan Venkateshwar wrote that rights fees could rise even higher than 75%.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

In his note, Venkateshwar said players’ shares reach 48.5% if TV revenue rises by 60% and hit 48.8% if revenue increases by 120%.

“Based on our conversations, the higher end of this range (+60% to 120%) isn’t too far off from current Street expectations for rights increases when the NFL’s deals come up for renewal in 2021 and 2022,” he wrote.

The question for cable networks and broadcasters is where those fees will come from. Nathanson believes that with the COVID-19 pandemic pressuring ad sales, programmers — especially smaller ones — will be forced to dip into the retransmission-consent and affiliate-fee well more deeply than ever. “In all, the combination of COVID-19 economic fallout and sharply higher cash payments for sports should pressure free cash flows of the smaller ViacomCBS and Fox forcing them to push for higher retrans and reverse retrans while pressuring their non-sports programming investments,” Nathanson wrote.

ViacomCBS’s sports rights costs would increase from $1.7 billion in 2019 to $2.2 billion (up 30%) in 2024, Nathanson estimated, while affiliate fees (revenue) will rise 75% from $2 billion to $3.5 billion. Fox, which has restructured its business to focus mostly on live news and sports, will see affiliate fees rise 50% from $3.2 billion in 2019 to $4.8 billion, while sports rights costs will increase from $3.3 billion to $4.4 billion (up 33%) by the end of 2024.

Not all of those affiliate-fee increases will be due to sports costs, but Nathanson pointed out that for both large and small programmers, sports accounts for between 60% and 90% of the total affiliate-fee haul.

The analyst wondered if higher sports fees could start a chain reaction: higher retrans fees could mean higher pay TV bills, possibly pushing poorer homes and non-sports watchers out of the bundle and leading to even higher pass-alongs to offset customer declines.

“In the long run, we think this will create a world where the traditional bundle serves only wealthier sports fans while non-sports fans seek OTT options like Netflix, Amazon, Hulu Disney+ and HBO Max,” Nathanson wrote.

At Kagan, a unit of S&P Global Market Intelligence, sports business analyst Adam Gajo said that sharp divide doesn’t yet exist but it could happen, especially as traditional pay TV continues to lose subscribers and streaming services offer more customized packages.

“With the next round of sports rights renewals coming up, the bidders will have to be aware of the market value, and make sure that they are able to pass the sports rights payments through to reach the subscribers,” Gajo said. “If — when — the price for sports continues to go up, with less people paying into it, I think we could get to the point where interested households can’t afford it.”