Cable Access Equipment Shipments Rise, But Revenues Slide

The first quarter represented a mixed bag for cable broadband access network equipment suppliers as DOCSIS channel shipments climbed but overall revenues in the category dipped due to aggressive pricing and a surge in software licenses, according to a new report from IHS that tracks shipments of cable modem termination system (CMTS), converged cable access platform (CCAP) and edge QAM products.

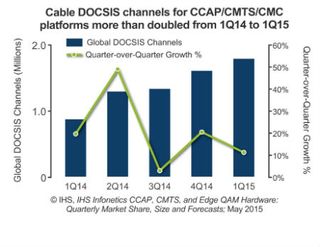

Thanks to ongoing upgrades, DOCSIS channel shipments rose to 1.8 million in Q1, up 14% from the previous quarter and up 48% from the year-ago quarter, but revenues tied to combined shipments of CCAP, CMTS, CMC and edge QAM equipment fell 7% sequentially in the first quarter, to $474 million.

"The cable broadband market got off to a mixed start in the first quarter,” Jeff Heynen, research director for broadband access and pay TV at IHS, said in a statement. “Despite the first quarter typically being a slow one, DOCSIS channels increased yet again. But revenue was down due to a combination of aggressive pricing and a higher proportion of software licenses.”

While the scuttled Comcast-Time Warner Cable merger was expected to dampen the cable access market in North America, “the overall cable broadband market remained healthy, setting the stage for a strong 2015,” IHS said in its report.

Among vendors, Arris dominated the market in the first quarter, due in part to the early availability of the E6000, Arris’s integrated CCAP, IHS said. Arris rival Cisco Systems introduced its integrated CCAP, the cBR-8, in May during the INTX show in Chicago, noting that shipments were underway with MSOs such as Comcast and Altice Group.

Update: Heynen said Arris represented 51% of revenue share in the product category (CMTS, CCAP, edge QAM and CMC equipment) in the first quarter, followed by Casa Systems (18.8%) and Cisco Systems (18.7%).

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.