Cable Stocks Creep Back Into Positive Terrain

About five months after hitting a trough in the wake of poor subscriber results across the sector, pay TV distributors’ stocks lurched toward positive territory in the third quarter, while content creators continued to build momentum.

The second quarter was a dark time for publicly traded cable distributors. In late April, after Comcast announced heavier-than-expected Q1 video subscriber losses (96,000, compared to analysts’ consensus loss estimates of about 75,000), Charter Communications followed with equally disappointing results (122,000 vs. expectations of 75,000 to 80,000 in losses). Coupled with better-than-expected subscriber gains at virtual multichannel video programming distribitors, the sector fell into a tailspin.

When the the dust settled, five of the largest pay TV distributors — Comcast, Charter Communications, Dish Network, Altice USA and Liberty Global — had hit new 52-week lows.

Now, just five months later, there’s better investor sentiment around improved second-quarter results (Charter lost 73,000 video customers in Q2, beating analysts’ estimates it would lose more than 100,000). Some analysts are even optimistic for the third quarter, hoping that even though the industry might not have quite turned the corner, it can at least see the street.

Overhangs Fall Away

Cable stocks have mounted a comeback as many of the so-called overhangs on the stocks have dissipated, Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak said.

“I would say we have a pretty nice U.S. cable-stock comeback,” Wlodarczak said. “Third-quarter results are set up to be solid and the fourth quarter and first quarter are seasonally the strongest results of the year.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

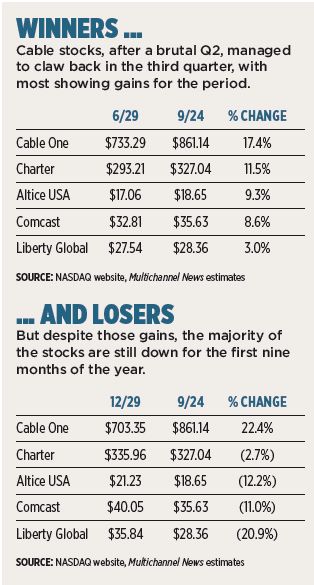

While most of the stocks did manage to report increases between June 30 and Sept. 22 — with one exception (Comcast) — they are still showing overall declines for the first nine months of the year.

Charter’s stock price rose 11.5% in the third quarter, but it wasn’t enough to erase earlier losses, as the shares finished down about 2.7% from the beginning of the year. The same held fast throughout the distribution sector: Comcast, up 8.6% in Q3, finished down 11% from Dec. 29, mainly because of poor investor sentiment around its $40 billion purchase of U.K. satellite giant Sky. Other stocks fared similarly — Altice USA was up 9.3% in the quarter and down 12.2% for the year, while international cable giant Liberty Global rose 4.6% in the quarter but fell nearly 21% for the year.

The lone exception was Cable One, the Phoenix-based midsized operator that has placed most of its focus on broadband. Cable One was up 17.4% in the quarter and rose 22.4% for the year. Investor displeasure with Comcast’s pursuit of Sky was no secret — the stock was down about 4% since the cable operator made known its intentions in February. Despite the continued decline, Wlodarczak sees a buying opportunity, adding that the Sky deal is modestly accretive from the start and Comcast stock is relatively cheap, trading at 10.5 times 2019 estimated cash flow.

“Yes, Comcast has arguably overpaid, but these type of assets rarely come up for bid,” Wlodarczak said, adding that the conclusion of the Sky deal “likely takes additional large deals off the table, at least in the medium term.”

The picture was arguably clearer on the programming side, where stocks continued to experience upward momentum.

Programming stocks overall were up 4% for the quarter and 11.4% for the year, fueled by growth at virtual MVPDs and moves by The Walt Disney Co. and others to launch direct-to-consumer offerings. Disney said earlier this month that its first DTC product — ESPN+ — has crossed the 1 million subscriber milestone, although that number includes past subscribers to its ESPN Insider service. Disney plans to launch an entertainment-focused DTC product in 2019.

That said, the quarter’s biggest gainer in the programming sector was Discovery Communications, up 16% in the period. Discovery, which had been hit hard by the decline in the overall TV ad market, saw its stock surge after landing carriage deals with OTT players Hulu With Live TV and Sling TV.

In a research note, Sanford Bernstein media analyst Todd Juenger said the deal provided a healthy boost to Discovery stock, but did leave some questions. “[I]s this good news because it shows Discovery will have presence on the increasingly skinnier U.S. TV bundles, or bad news because it shows Discovery’s future domestic portfolio will have 8 networks instead of 16, reducing domestic revenue by 15%?” Juenger wrote.

Signs of OTT Weakness

Over-the-top players such as Netflix and Amazon Prime Video have enjoyed big gains this year, but are beginning to show some signs of weakness. Netflix stock has more than doubled since the beginning of the year, but was down nearly 6% in the third quarter. And Amazon, up 45% in the second quarter, slowed to a 14% gain in the third.

Despite the growth of vMVPDs, Wlodarczak wasn’t convinced they would turn out to be the savior of the pay TV business. While programmers may get higher affiliate-fee payments from vMVPDs, in many cases the trade off has been reduced carriage for some networks, he said. Quality-of-service issues at some providers and higher standalone broadband prices that cancel out content savings can further diminish value.

“People are leaving pay TV because it costs too much relative to emerging cheaper entertainment alternatives like Facebook and Netflix,” Wlodarczak said. “I don’t think anything has changed for the media guys.”