Cable’s Corona Conundrum

Cable operators have responded quickly to the COVID-19 outbreak, laying the groundwork for what has become a nationwide work-fromhome push, making sure broadband connections can handle the strain and ensuring that low-income residents, seniors and people in need can get access to a vital high-speed internet connection.

Seemingly every U.S. cable operator is offering some form of free broadband service to low-income homes with school age children for up to 60 days. On April 1, midsized operator Sparklight (formerly Cable One) said it would extend its unlimited data offering for all of its broadband tiers until May 12.

At last count, more than 650 companies and associations across the country have taken the FCC’s “Keep America Connected Pledge,” agreeing for the next 60 days to not disconnect service for nonpayment related to COVID-19 disruptions, waive late fees and open WiFi hotspots that weren’t available to the public.

Operators also said they are working hard to ensure the safety of their employees, with most requiring the bulk of their workforces to perform their jobs at home, including field techs and call-center workers.

More Are Working From Home

At Comcast, the country’s largest cable operator is asking every employee who can work from home to do so. On March 30, Comcast said it expected to have more than 90% of its call-center employees working from home. That is up from about 30% just a few days ago.

“Our ability to work from home is running well,” Comcast’s chief technologist Tony Werner said in a conference call with reporters.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

For positions where working from home is impossible — like field techs — Comcast is offering financial incentives and is implementing stringent safety procedures like temperature checks, performing as much work outside the home as possible and distributing self-install kits to customers that have requested to be set up with new service.

“We are at a time when our customers need us more than ever and protecting everyone’s safety is absolutely critical,” Comcast said in a statement.

One Comcast tech has already died from COVID-19, an unidentified 34-year veteran of the company who worked in Fairfield, N.J. Comcast said the employee made several home visits in the Fairfield area between March 3 and March 6, and though there is no evidence any of his customers tested positive for COVID-19, the company and city are working together to identify any potentially exposed people and determine their status.

At Charter, service installation truck rolls have increased significantly from their average of about 12,000 per day, after the company announced 60-day free broadband access for low-income homes with school-age children. In a March 20 memo to employees, Charter said it is currently fielding more than 50,000 requests for internet service per day. Truck rolls for service repairs have risen to about 30,000 per day, Charter said in the memo. And call-center employees have seen the number of calls they receive double over the past few weeks. In the March 20 memo, Charter said that its inbound sales and retention teams fielded more than 200,000 calls in three days.

Since March 20, Charter said it will no longer do professional installations where self-install is available.

At its call centers, Charter faced some backlash from workers because of its earlier ban on working from home, but the company has ironed out those kinks and most employees are working remotely. For those who still must go into the office, Charter is taking precautions to ensure that employees are practicing social distancing and following other CDC safety guidelines.

Charter added on April 2 that it will increase the minimum wage for all hourly employees from $15 per hour to $20 per hour by 2022. While that increase will be phased in over time, Charter said field technicians and call-center workers will get the increases immediately.

According to the company, an initial retroactive $1.50 increase will be implemented immediately for hourly frontline employees in the field and customer operation groups and will receive another permanent $1.50 per hour raise on top of their March 2021 merit increase.

Altice USA said in a statement that its immediate focus is on the safety of its employees, customers and communities and starts with awareness and ensuring the workforce has the proper information and guidance. As of April 2, Altice USA said most of its employees are working remotely and for those who can’t — primarily field techs and retail workers — it is offering a 20% pay increase based on hours worked.

Cox Communications said that just a couple of weeks ago fewer than 15% of its call-center employees were working remotely. By March 27, the company estimated more than 92% of call-center workers were doing their jobs from home.

Cable executives are also stepping up during the outbreak, donating personally to several organizations, taking pay cuts and in some cases giving up their salaries in the wake of the pandemic.

The Walt Disney Co. executive chairman Bob Iger said he would forego his fiscal 2020 salary as a result of the virus. New CEO Bob Chapek said he would take a 50% pay cut, while the salaries of senior VPs would be reduced by 20% and executive VPs by 30% during the crisis.

“While I am confident we will get through this challenging period together and emerge even stronger, we must take necessary steps to manage the short- and long-term financial impact on our company,” Chapek wrote in a memo to employees.

On April 2, Disney said it would furlough non-essential employees due to the COVID-19 outbreak, beginning on April 19. While the company did not specify which divisions would be affected, it is likely many would come from its theme parks, which have been shut down indefinitely. Furloughed workers will still receive healthcare benefits and are eligible for state unemployment insurance and a weekly stipend from the federal economic stimulus package.

At Comcast, chairman and CEO Brian Roberts and his wife Aileen donated $5 million to the Fund for the School District of Philadelphia for laptops for students. In addition, Roberts said he and other Comcast execs — Comcast Cable CEO Dave Watson, Comcast chief financial officer Mike Cavanagh, NBCUniversal CEO Jeff Shell (who tested positive for COVID-19 and is working remotely) and Sky group chief Jeremy Darroch — would donate their salaries to charities tied to COVID-29 relief.

Roberts also noted that Comcast has committed $500 million to support employees during the pandemic through continued pay and benefits.

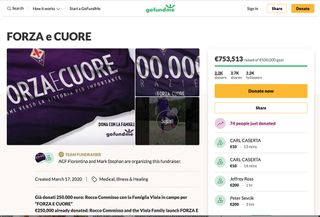

Mediacom Communications chairman and CEO Rocco Commisso started a Go Fund Me campaign to raise money for hospitals in Florence, Italy, the home of his soccer team, AC Fiorentina. Commisso personally seeded the effort with €250,000, hoping to raise €500,000 over time. The effort, Forza e Cuore or “Strength and Heart,” passed that goal within days and as of April 2 had raised €751,853.

On the business side, cable stocks have been on a roller coaster ride with the rest of the market. The Dow Jones Industrial Average had its worst Q1 ever, down 23%. Cable stocks fared better, with distributors up 4.4%, mainly because of a big surge by broadband-centric Cable One in the past few weeks. Factoring out Cable One, operator stocks fell 11.7% in the quarter. Programmers had a rougher time, falling 41.3% in the period while telcos and satellite stocks were down 24.3%.

As a result, many publicly traded programmers have withdrawn their 2020 financial guidance estimates — AMC Networks, ViacomCBS and Discovery — as uncertainty continues to mount.

Pay TV and streaming video providers have seen a surge in viewership and engagement as more people are confined to their homes. But while that may show up in lower churn numbers in the future, as consumers face layoffs and other economic hardships tied to the virus, it could have the opposite effect.

Consumption Up, Economy Down

As of March 30, Comcast said streaming and web video consumption was up 38% among its customers. Linear TV also is experiencing a surge, with consumption up by four hours to 64 hours per week, and on-demand viewing is reaching record levels, up 25% year-over-year. Voice remote requests for “free movies” are up 50%, with overall voice remote queries reaching 50 million on some days.

While a lot of the concern centers around the advertising market — MoffettNathanson analyst Michael Nathanson estimated 2020 TV ad sales could fall 11% — there is a growing fear that continued layoffs and other economic hardships could impact pay TV subscriber rolls.

Unemployment claims are consistently breaking records: they doubled to 6.6 million for the week ending March 28, compared to 3.3 million in the previous week, according to the U.S. Department of Labor. Increasingly, the economy looks like it might be headed for a major recession. That could mean accelerated video customer losses for operators going forward.

“[W]e believe video subscriber losses will accelerate, with the recession and lack of sports focusing consumers’ attention on pay TV as a ~$1,000/year savings opportunity,” Sanford Bernstein media analyst Peter Supino wrote in a note to clients. He estimated the impact could be as much as 1.5 million fewer video additions in the first half of the year for the pay TV sector.

For most, the real test may come after the pandemic subsides. Depending on how long consumers are stuck at home, they are likely to emerge with at least some different bandwidth and content consumption habits, whether it be working from home, streaming more video or watching a lot less linear TV. It will be up to MSOs and networks to figure out how to satisfy them. With almost every analyst predicting the economy is headed for a deep recession, that battle may have only just begun.