COVID-19 Could Squeeze Networks More in Q2

The COVID-19 pandemic is expected to continue to squeeze advertising revenue at the top cable networks in the first quarter, but the full force of its impact likely won’t be felt until the second quarter and beyond, according to several analysts.

Networks have seen viewership increase as consumers were confined to their homes in the pandemic’s early days. That won’t have as much of an effect on revenue in Q1 (the lockdown was only about two weeks old at the end of the period), but the real impact could be in the second quarter and beyond.

Just how much of an impact will be known soon. Most top programmers are set to release results in the next few weeks. The Walt Disney Co. and AMC Networks are expected to release results on May 5, followed by Discovery and Fox on May 6 and ViacomCBS on May 7.

Heading into the earnings season, analysts were a little spooked by what MoffettNathanson principal and senior analyst Craig Moffett called WarnerMedia’s “shockingly bad” Q1 performance reported on April 22.

WarnerMedia Worries

WarnerMedia was hampered by the cancellation of the NCAA March Madness men’s basketball tournament — a staple of its Turner networks — and costs associated with the May 27 launch of its latest streaming product, HBO Max. Turner revenue was down 8.2% in the period, which helped drive overall WarnerMedia sales down 12.2%.

On a conference call with clients, Moffett said the results don’t bode well for WarnerMedia in later quarters, when the pandemic’s full impact will be felt. “You can just imagine how deep the problems there will become,” he said. “I really think you can see the wheels utterly falling off that business by the end of this year.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Turner notwithstanding, it could be a rough couple of quarters for programmers as a whole. Perhaps the hardest hit will be networks relying on sports programming, which is virtually nonexistent in the pandemic, to drive advertising revenue. Other programmers also are expected to report sluggish results through the first half of the year.

Moffett’s colleague, MoffettNathanson media analyst Michael Nathanson, estimated Disney, Discovery and other programmers could face more difficult times as the pandemic plays out.

“The challenge is we don’t know when things will return to normal,” Nathanson said on the call.

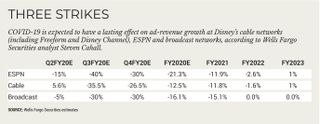

Many analysts believe that the sector is headed for an ad recession that could last a while. At Wells Fargo Securities, media analyst Steven Cahall lowered his estimates for Fox, Discovery, ViacomCBS, Disney and Discovery.

Most of that pain is going to come in the calendar second quarter and beyond. Unlike WarnerMedia, most analysts see at least a thin silver lining for programmers before they enter the dark cloud.

At Fox, for example, Cahall expects cable network advertising to be flat in fiscal Q3 at $276 million, while television advertising revenue should rise 65% to $1.3 billion, driven largely by increased news ratings. The lack of sports won’t really make a mark until Fox’s fiscal Q4, where Cahall estimates cable network revenue will decline 15% and television ad sales will be down nearly 30%. He sees that trend continuing into fiscal Q1.

“We think Fox heads into upfront season in a challenging spot, including weak pricing, less live sports inventory and uncertainty about the NFL season,” Cahall wrote in a client note.

At Disney, arguably the most affected by the pandemic shutting down sports, theme parks, movie and TV production, the outlook is mixed. In a research report, Sanford Bernstein media analyst Todd Juenger reduced ad revenue estimates for Disney’s Media Networks (including ESPN) by 40% in calendar Q2 and by 15% in calendar Q3, followed by a recovery path into 2021 that could either turn into a quick economic recovery or a lengthy recession.

Cahall estimated that ESPN ad sales will dip by 15% in calendar Q2, followed by a 40% decline in calendar Q3 and troubles continuing into the first half of 2022.

“While the early ad reductions reflect a lack of sports including NBA and college, our estimates also include CPM compression, even as sports return,” Cahall wrote.

Direct-to-Consumer Lifeline

One bright spot for Disney could be its direct-to-consumer subscription services Disney+ and Hulu. Disney+ has gotten most of the attention: It had one of the most successful product launches ever in November, and said earlier this month that it has reached 50 million global subscribers. Domestically, the numbers are at about 23.9 million subscribers, but Cahall estimates it could reach 34.9 million subs by 2024, generating more than $2.4 billion in revenue.

For other programmers the road will be equally rocky.

Cahall estimated domestic ad sales would rise 8% at ViacomCBS in Q1 (despite also being affected by the loss of March Madness), but fall 20% in Q2 and Q3 and drop another 10% in Q4. Juenger predicted a “significant” domestic ad revenue decline at Discovery and a mid-teens drop at AMC Networks in the quarter, all due to the current climate.

Analysts did see some bright spots in the various networks’ OTT offerings, with Viacom expected to push its OTT subscribers from about 11 million before the pandemic to 16 million by the end of 2020.

Nathanson said NBCUniversal’s planned launch of Peacock could represent opportunities to increase revenue without having to lay out the expense of creating a standalone offering.

Whatever they decide, to survive, networks and distributors have to prepare for the long haul, Moffett said.

“I think what the market is starting to price in is not a V-shaped recovery,” Moffett said. “The recovery of the market sort of prices in this sort of dystopian future where a handful of companies with really strong balance sheets survive what could turn out to be a brutal shakeout of the macro economy.”