Distributors Buck Stock Trend in 2019

For years, Wall Street heaped praise and lofty multiples on content providers, turning a jaundiced eye to the distributors that delivered that programming. For many investors, cable networks were the growth engines while distribution was a declining business that should best be avoided. In 2019, cable operators got their revenge.

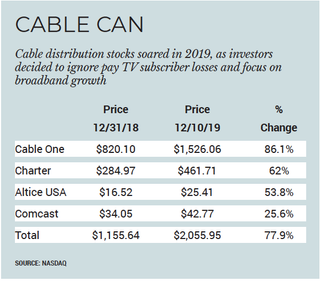

Cable distribution stocks, fueled by continued strong broadband growth, grew 78% for the year, their largest gain in more than 20 years. The last time the distribution sector had a comparable gain (80%) was in 1998, according to Multichannel News estimates.

Although there are substantially fewer publicly traded cable distribution companies in 2019 (4) than in 1998 (10), today’s cable operator is facing competition on several fronts — satellite, telco and OTT — increasing programming costs and a customer base that is increasingly moving away from the traditional pay TV subscription model.

The lift was a big change from the prior year, when the four stocks in the sector rose about 5%, and signals an even bigger shift in sentiment. In a landscape where content is increasingly delivered over broadband connections, losing video customers doesn’t seem to matter much anymore.

Reliable Broadband Is Golden

“I think people have realized that broadband products have higher margins, they have lower churn, you don’t have to market them, you don’t have to deal with content providers,” FBN Securities media analyst Robert Routh said. The argument that younger viewers don’t watch TV also falls to cable’s advantage, because the streaming video they do watch requires a fast, reliable connection. “There are only so many entities that have that ability,” he said.

Video subscriber losses continued to rise and are expected to travel along that path for the foreseeable future. The sector lost about 3.8% of its video base in Q3, but broadband growth is steady. Leichtman Research Group estimated that cable grew its high-speed internet base by 14% in Q3 and represents more than two-thirds of total broadband connections across the country.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

In addition, past fears that over-the-top providers like AT&T’s DirecTV Now, Sling TV and Sony’s PlayStation Vue would chip away at cable’s video subscriber base have been largely unfounded. Sony said in October it would shutter PlayStation Vue in January. DirecTV Now (now AT&T TV Now) was on pace to crack 2 million subscribers after a strong Q3 2018 but a series of price increases halted that growth and now the service has about 1.1 million customers. Some analysts believe that once AT&T launches IPTV offering AT&T TV in 2020, AT&T TV Now could disappear.

Sling TV had a resurgence in Q3, adding about 214,000 customers after five straight quarters of additions of fewer than 50,000 subscribers. At the same time, Sling parent Dish Network saw subscriber losses at its satellite-TV unit slow to 66,000 in the period (compared to a loss of 367,000 in Q3 2018) indicating to some that it may have reached equilibrium, as its rural subscriber base has fewer choices when it comes to pay TV and broadband. Dish, whose stock was up 34.3% for the year, also has been focusing on building out its wireless spectrum. Dish also agreed to buy wireless assets from Sprint and T-Mobile as a condition of those firms’ pending merger. That would make Dish the fourth largest facilities-based wireless communications provider in the country.

Fears that video distribution mantle would be passed to over-the-top competitors only heightened in 2019, with the debut of The Walt Disney Co.’s Disney+ and Apple’s Apple TV+ direct-to-consumer services and the pending launch of HBO Max and AT&T TV in 2020. While Disney+ lived up to the hype, signing on more than 10 million subscribers on day one, the fear that these services would replace pay TV has shifted to a belief that they, like Netflix, Hulu and Amazon Prime Video, will complement linear offerings. Even if they don’t, cable still has the most reliable broadband connection over which all these new services travel.

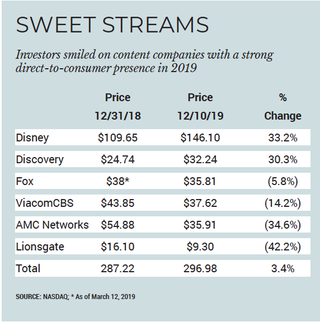

Programming stocks were up about 3.4% for the year, mainly driven by gains at Disney, up 33.2%, and Discovery, up 30.3%. Other stocks in the sector fell as declines in overall pay TV rolls negatively affect affiliate fees.

“Altogether, U.S. cable network distribution revenues continue to look shaky,” MoffettNathanson media analyst Michael Nathanson wrote in a research report.

On the distribution side, analysts like MoffettNathanson principal and senior analyst Craig Moffett have been saying for months that cable operators shouldn’t sweat video customer losses as long as their broadband service thrives. So far, it looks like that is exactly what is happening.

“Just a few years ago, video subscriber losses were the foundation of the cable bear case,” Moffett wrote in a recent note to clients. “Gradually, that fear faded. Video subscriber losses became something that investors were willing to ignore. Now, it’s something investors are hoping for.”

In initiating coverage of the sector earlier this year, Sanford Bernstein media analyst Peter Supino wrote that the “decline of cable video obscures rapid and durable cash-flow growth.”

It is no accident that the top performing stock in the cable distribution sector for the past three years has been Cable One, which began de-emphasizing video service in 2014. Cable One, which renamed itself Sparklight this year to reflect its focus on high-speed data service, has lost about 21% of its video customer base since 2015. During that same period, its stock price has risen 265%.

This year was one of Cable One’s best: Its share price has risen 86.1% this year to close at $1,526.06 on Dec. 10, nearly double the Dec. 31, 2018, closing price of $820.10.

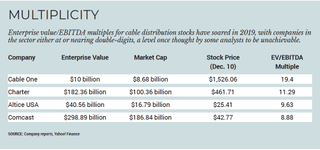

Cable One has the highest cash-flow margins in the industry at 49.5% in the third quarter, almost 10 percentage points higher than the largest cable operator in the country, Comcast, at 39.8%. Cable One’s trading multiple, at 19.4 times cash flow, outpaces its closest peer, Charter Communications (11.29 times), by a wide margin.

“There was a time when a 10 times multiple for a cable stock would have been unthinkable,” Moffett noted.

The other stocks in the sector are also flirting with that benchmark. According to Yahoo Finance, Comcast is trading at an 8.8 times multiple and Altice USA at a 9.6 times multiple.

High trading multiples can mean positive things — investors becoming comfortable with video declines and confident that the sector’s broadband dominance is sustainable — and negative things: the stocks could be overvalued.

Routh said the rise in distribution multiples is more a sign that the market is valuing these stocks correctly.

“The question is what is the right valuation given the long-term prospects for those businesses,” Routh said. “I don’t think they’re overvalued yet and I do think they are certainly safe and better investments than other things I can think of. But I do question how much more is there, given where they are now.”

Charter, Altice, Comcast All Rose

Distribution stocks all had a strong year. Aside from Cable One, which led the pack, Charter stock was up 62% for the year and Altice USA, which despite a churn spike in the third quarter, finished the year up 53.8% to $25.41 per share. Comcast stock rose 25.6% from the year’s start to close at $42.77 on Dec. 10.

What also seems to set this year apart from the rest is that there were no major M&A deals in the distribution sector to drive the stocks. Cable stocks are traditionally deal driven. In 1998, the stocks were bolstered by widespread industry consolidation — 1997’s so-called Summer of Love — and AT&T’s purchase of Tele-Communications Inc. in June 1998. In 2016, when distribution stocks rose 40% for the year, Charter Communications had completed its pursuit of Time Warner Cable, an $80-plus billion deal that was supposed to usher in a new era of consolidation that hasn’t yet materialized.

Most recently, the merger activity has been on the content side: Disney closed its $71.3 billion purchase of certain 21st Century Fox assets in March. The other big deal, AT&T’s $108.7 billion purchase of Time Warner, closed in June 2018, although a Justice Department attempt to block the deal was thwarted in federal appeals court on Feb. 26.

At the UBS Global TMT conference in New York Dec. 10, Altice USA CEO Dexter Goei said he believes “large scale M&A is inevitable” across the infrastructure sector, but stopped short of saying whether his company would be a buyer or a seller.

“We’re always open to having discussions,” Goei said at the conference. “No one’s going anywhere, but we’re very, very focused on maximizing shareholder value.”

Consolidation could come to the distribution sector, as many analysts believe that Cable One and Altice USA could snap up several small operators across the country. Those deals wouldn’t move the needle much, though. The top three pay TV distributors — Comcast, DirecTV and Charter — account for more than half of the 93.4 million U.S. pay TV homes.

Still, Routh believes that distribution stocks have a lot of runway left in them, adding that low to mid-teens percentage growth for the sector is possible in 2020.

“It’s not just what I think,” Routh said, adding that he has heard similar optimism from investors. “I haven’t heard anyone think the opposite, at least anytime recently, which wasn’t the case a few years ago.”