Fox RSN Sale Is on the Clock

The Walt Disney Co.’s months-long effort to sell 22 regional sports networks might be getting close to wrapping up, now that Disney’s deadline clock has formally begun.

Disney said it would sell the RSNs as a condition to winning federal approval of its $71.3 billion purchase of 21st Century Fox programming and production assets. As part of that agreement, Disney agreed to have sale agreements in place within 90 days after closing the larger Fox deal, which occurred on March 20.

According to people familiar with the auction process, the next round of bids — most likely the final round, given the 90-day window — is due in mid-April. At press time, the leaders appeared to be a team owners’ group, including John Malone’s Liberty Media; and Major League Baseball itself.

Whether or not that means a winning bid will be picked in April still remains to be seen. The 90-day deadline to close the sale would mean a deal would have to be done by June 18. But those same people familiar with the auction said that as long as progress is being made, an extension could be applied for, which would push the deadline to Sept. 16.

Bidders Have Had Time to Ponder

Disney began this process in June 2018, after the Justice Department approved the Fox transaction. Books on the networks went out in October.

One deal is done or at least is in the eighth inning, metaphorically: YES Network’s sale to the New York Yankees. The Yankees, which own 20% of the channel and had the right of first refusal to purchase Fox’s 80% interest in the event of a sale, exercised that right earlier this month, teaming up with Amazon, Sinclair Broadcast Group and several private-equity firms to buy it for an estimated $3.5 billion, less than the $4 billion most expected the network to fetch. When the deal closes, the Yankees will own the majority of the channel.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

While the YES deal hasn’t been officially announced, most observers believe that is merely a formality as the network is waiting until the other RSNs are closer to a sale before making the big reveal.

Sinclair, which in February announced a partnership with the Chicago Cubs for an RSN called Marquee Sports that will launch in 2020, is apparently still interested in adding to that portfolio. During an earnings conference call on Feb. 27, Sinclair CEO Christopher Ripley alluded to reports concerning opportunities that Sinclair may have in the space.

RELATED STORY: Fox Closes Disney Deal, Issues Affiliate-Fee Warning

“I can’t comment specifically on those reports, due to non-disclosure agreements we’ve signed,” Ripley said. “But there is a very unique moment in time here in the RSN space that we really like our positioning on.”

There have been a steady stream of potential suitors for the remaining RSN assets. Private-equity firms like Apollo Global Asset Management; consortiums of teams and investors; rapper Ice Cube, and others have all expressed interest.

According to Fox Business Network’s Charlie Gasparino, Disney and MLB were discussing “add-ons” to the league’s bid, mainly a “national rights extension” that would allow the league to air some games on ESPN that the RSNs own the rights to.

Gasparino said those discussions seemed to hint that MLB was in the lead.

One source familiar with Big 3 Networks, the professional three-on-three basketball league owned in part by Ice Cube, said it remains very much in the hunt for the channels. Big 3 has secured partial backing from boutique PR firm Centerbridge Partners.

Malone was said to be interested mainly to protect the interests of the team Liberty owns, the Atlanta Braves. There was a fear among owners of smaller market teams that an outside buyer would allocate more resources to networks with teams in larger cities, leaving the smaller markets in the lurch.

Other team owners have reportedly entered the fray as well. Platinum Equity chief Tom Gores, who also owns the National Basketball Association’s Detroit Pistons, has conferred with Malone about a bid, as has Minnesota Twins owner Jim Pohlad. Other baseball teams including the Arizona Diamondbacks, the Los Angeles Angels (owner Arte Moreno was reportedly interested in bidding on Fox Sports West, Prime Ticket, Fox Sports Arizona and Fox Sports San Diego) and the Milwaukee Brewers have also considered making bids, according to reports.

Bids Seem to Be Coming In Low

Unfortunately for Disney, the networks, including Fox Sports channels in Atlanta, Detroit, Kansas City and Phoenix, have reportedly attracted bids in the $10 billion range, or about half of the $20 billion first expected.

The emergence of Malone was said to have raised the price slightly — to maybe as high as $13 billion — but still below the original target.

Live sports and news are primarily the two remaining areas of programming that are attracting meaningful ad dollars. And sports on RSNs consistently place high in the ratings.

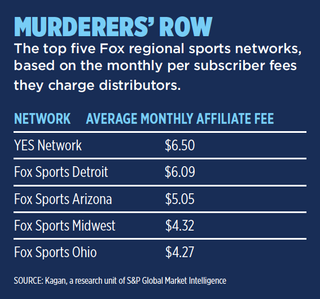

But regional sports networks have distribution concerns. Already saddled with a reputation of being too costly — YES Network, according to Kagan, a unit of S&P Global Market Intelligence, costs distributors about $6.50 per subscriber per month — they have been placed on tiers by most cable and satellite service providers, which limits their audience.

“With the 90-day clock beginning with the close of the Disney/21st Century Fox sale, and YES not getting its full estimated value, I don’t think the other RSNs will be able to either,” Kagan sports analyst Adam Gajo said in an email message.