News

Latest News

Freeze Frame: Cable Hall of Fame 2024 (Photo Gallery)

By Michael Demenchuk published

Images from the induction ceremony held April 18 at New York’s Ziegfeld Ballroom

NBA Playoffs Will Offer Viewers Something Familiar, Something New

By R. Thomas Umstead published

ESPN, TNT Sports hope mix of fresh teams, players and postseason stalwarts will drive ratings

Fremantle Hires Jeff Boone as VP, Scripted Development

By Jon Lafayette published

Exec had been at Bad Wolf

NHL, NBA Playoffs Begin; Haney-Garcia PPV Boxing Event: What’s on This Weekend in TV Sports (April 20-21)

By R. Thomas Umstead published

A look at the weekend's top TV sports events on broadcast, cable and streaming services

Hall of Fame Boxing Announcer Jim Lampley Chatting Up the Sweet Science on PPV.com (Q&A)

By R. Thomas Umstead published

Will host PPV.com’s live chat for the April 20 Devin Haney-Ryan Garcia PPV boxing event

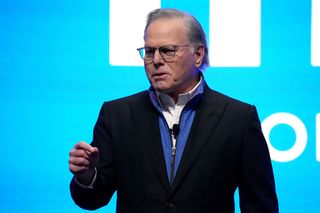

Warner Bros. Discovery CEO David Zaslav Got 27% Raise to $49.7 Million in 2023

By Jon Lafayette published

Other top WBD execs also saw their compensation increase

DAZN Weighs in With Content Ahead of Haney-Garcia Fight

By Jon Lafayette published

‘Run It Up’ is hosted by Rachel DeMita, Demetrious Johnson, Master Tesfatsion

Daytime Emmys Announce Some Nominations Early

By Paige Albiniak published

Entertainment magazines get early scoop in several categories

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.