Icahn Says Wants Role in Gannett Split

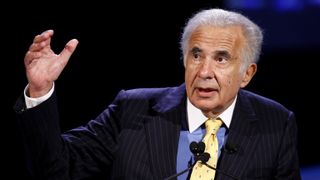

Activist investor Carl Icahn recently bought nearly 15 million shares in Gannett Co., or 6.6% of its outstanding stock, adding that he wants to play a role in its plans to split its publishing and broadcasting units.

According to a 13D filing with the Securities and Exchange Commission, required of holders of 5% or more of a public company’s stock, Icahn began acquiring shares of Gannett in mid-June, about two months before the company disclosed it would split its 46 television broadcasting stations and publishing unit (including national newspaper USA Today) into two separate publicly traded units. The split, which is expected to close in the fourth quarter, would create two pure play publishing and broadcasting stocks. Some analysts have speculated that the Gannett split, and others proposed by Tribune Co. and E.W. Scripps, could create a second wave of consolidation among owners of TV stations and give them more clout in retransmission consent negotiations with pay TV distributors.

In the SEC filing, Icahn, who has a reputation for buying large stakes in companies and pushing for management and operational changes, said he believed Gannett shares were undervalued. Although he has not yet met with Gannett officials, the document stated that Icahn and his representatives “intend to have discussions with representatives of the Issuer's management and board of directors relating to the planned separation, corporate governance, capitalization and capital allocation.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.