Is the Retrans Cash Cow Running Low?

Over the past nine months, cable operators and broadcasters have been at each other’s throats more than ever, fueled by fears of greater regulation and a declining pay TV customer base. According to some analysts, as broadcasters have increasingly relied on retransmission-consent cash to prop up a shrinking ad business, many are digging in their heels not only for higher fees, but for guarantees they will be paid regardless of the impact of cord-cutting.

Retransmission consent has been a boon for broadcasters ever since it was included in the 1992 Cable Act, federal legislation that required television stations to elect for either “must-carry” status — meaning pay TV distributors had to carry them, usually at no charge — or retransmission consent, meaning they would be paid for their signals. Once considered to be a supplement to the larger fees broadcasters extracted from advertisers, according to Kagan, a unit of S&P Global Market Intelligence, retrans is approaching 50% or more of many station owners’ annual revenue.

But like everything else in the TV business, retrans is beginning to fall victim to its own success. As fees have risen, distributors and consumers are beginning to resist the high cost of broadcast.

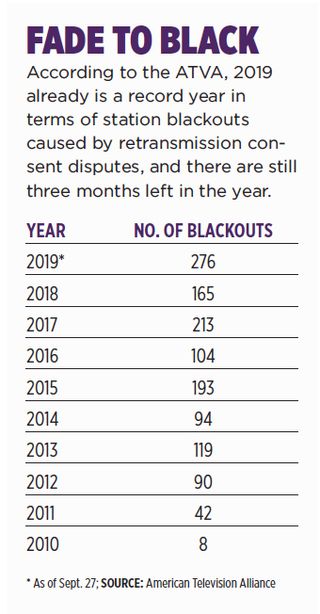

More Blackouts Than Ever

That has become evident in the number of retransmission consent disputes that have resulted in at least temporary blackouts of service. According to the American Television Alliance, 2019 is already a record year for retrans blackouts, with 276 stations affected. With three months still left in the year — and December is one of the more volatile months for retrans contract expirations — 2019 could easily break the 300 mark, or about double the 165 station blackouts recorded in 2018.

“If broadcasters continue on this pace, then the sky’s the limit,” ATVA spokesman Justin Bartolomeo said in an email.

Adding to broadcasters’ urgency is the expected renewal of the federal Satellite Television Extension and Localism Act (STELAR), currently under review for renewal. Most cable operators are hoping that the renewal will include retransmission-consent reform.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

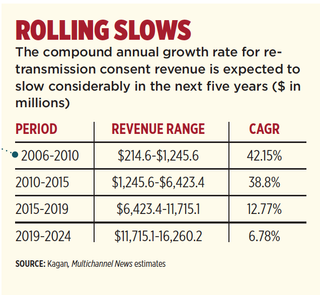

According to Kagan, retrans revenue is expected to reach $11.7 billion in 2019, an increase of 10.8%. But while retrans revenue has doubled in the past five years from $6.4 billion in 2015 to $11.7 billion in 2019 (a 12.7% compound annual growth rate), that pace is expected to slow considerably over the next half decade. Kagan predicts that retrans revenue will reach $16.26 billion in 2024, for a CAGR of about 6.7%.

There are several factors involved in the slowdown, Kagan senior research analyst Justin Nielson said, including how retrans is actually paid. Stations collect fees from traditional distributors in their service area and pass on a percentage to their respective networks — so-called reverse retrans fees — while virtual distributors pay the networks themselves, which then dole out a percentage to the respective stations.

“That has some impact in terms of the growth rate of the top line, because you’re melding gross retrans and net retrans from the virtuals,” Nielson said. “But also you’re looking at cord-cutting from the traditional side not being replaced directly from the virtual side.”

Stations are getting, on average, 30% to 40% of the fees paid on the virtual side, compared to around 50% of the fees from traditional distributors, Nielson said. But that latter cut also is on the decline, he said, as networks insist on a bigger bite of the apple as new deals are reached. In some cases, stations are giving as much as 60% of their retrans revenue to their respective networks, according to Kagan.

Wolfe Research managing director Marci Ryvicker also has warned that retrans is headed for a fallow period. At the TVB Forward conference in New York on Sept. 26, Ryvicker warned that while retrans growth is expected to be in the 12% annual range for the next five years, it will drop to around 7% after 2024. The main culprits for that falloff are cord-cutting and rising fees. Ryvicker estimated that pay TV subscriber rolls are declining at about 6.6% annually, a pace that will continue for the foreseeable future.

Fees Might Outpace Demand

According to Kagan, the average retrans fee charged by a broadcast station will reach $2.93 by 2022, putting it behind only ESPN ($11.08) and cable channel TNT ($3.09).

That’s still well behind what broadcasters say they’re worth. The National Association of Broadcasters says that broadcast channels account for about 40% of overall TV viewership, yet receive only 15% of the distribution revenue. If the broadcasters received 40% of TV revenue, Ryvicker estimated, retrans fees would balloon to between $7 and $8 per subscriber, a level that would essentially price them out of the market.

That would mean consumers would pay between $28 and $32 per month for the Big Four broadcast networks, content they could receive for free over the air. “There is such a thing as outpricing the consumer,” Ryvicker said at TVB Forward, according to reports.

Today, Kagan estimates that typical Big Four network affiliates receive between $2.50 to $3 per month per subscriber in retrans fees from traditional distributors, while virtual MVPDs pay out about $3.99 per month per subscriber directly to the networks.

Nielson said he believes that retrans rates paid by vMVPDs will likely be the next big bone of contention, especially for AT&T and Dish Network, which own both traditional and vMVPD services.

“They’re definitely trying to cut costs as much as they can in terms of programming, because margins on those are very slim,” Nielson said.