Live Streaming Makes Strides: FreeWheel

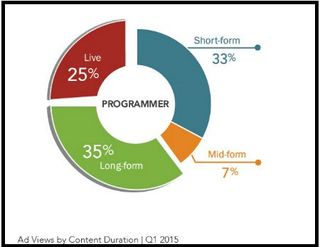

Streaming of live TV represented more than 25% of programmer ad views in the first quarter of 2015, FreeWheel, the online ad tech company acquired by Comcast last year, found in its latest Video Monetization Report.

With those numbers factored in, a combined 60% of video ad views came from long-form (20 minutes or more) or live content, said FreeWheel, which found that viewing of digital live content jumped 140% year-over year.

Sports continued to dominate the live streaming landscape, representing 82% of live video ad views in Q1, versus 11% from news, and 7% from live simulcasts of entertainment-focused content (up from 5% in the previous quarter).

FreeWheel said the majority (57%) of long-form and live monetization came from authenticated/TV Everywhere viewing (viewing that occurs after the consumer enters their MVPD credentials). Overall, authenticated viewing climbed 328% year-over-year, driven by sports (50%) and entertainment (45%), and news (5%).

Digital on-demand viewing continued to be much more diverse, led by documentary/reality fare (23%), scripted dramas (18%), music/trailers (17%), and news and sports (13% each).

Digital viewing continues to shift away from desktops and laptops. About 33% of monetization in Q1 2015 occurred on those platforms, but all other device categories (smartphones, tablets and OTT devices such as Roku and Apple TV boxes, Chromecast adapters, gaming consoles and smart TVs) saw at least double-digital growth, FreeWheel said, noting that Q1 represented the strongest period of OTT growth since it began tracking it.

Boiled down further, Roku’s share of OTT video ad views grew to 43% in Q1, while the Apple TV and gaming consoles sector each held about 20% of the market, the ad tech company said.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

From a broader standpoint, Freewheel said the maturity of digital is establishing what it’s labeling as “the new living room” as the same high-quality TV content traditionally consumed in the living room is now being viewed by the same audience through a multitude of screens and locations.

In Q1 2015, “the data tells a clear and familiar story: premium digital video continues to grow and mature at a rapid rate,” FreeWheel said.