Market Reaction Muted to Freewheel WiFi Splash

Cablevision stock was relatively quiet on Monday despite its Freewheel WiFi-only product launch, an offering that one top analyst said could be a test bed for a more compelling WiFi-first phone in the future.

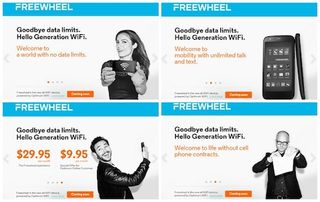

Cablevision shares finished Jan. 26 up 3 cents per share (0.15%) to $19.72 each, after being down slightly earlier Monday, the day it officially launched Freewheel, its WiFi-only product that offers unlimited data, text and voice for $29.95 per month. Existing Cablevision wireline broadband customers can receive the service for an extra $9.95 per month.

While Cablevision envisions the product – which will be available early next month – as the answer for cost-conscious consumers, college students and home and office workers with access to WiFi networks, the service does have some drawbacks, the biggest being its tendency to cut out once the user leaves a hotspot area.

Analysts have predicted that operators would use a hybrid WiFi/cellular product (so-called WiFi-first phones) to take advantage of their robust networks, and though Cablevision said it didn’t think it needed cellular back-up given the usage patterns of most young consumers, at least one analyst believes Freewheel could be a test-bed for a more complicated product.

In a note to clients Monday, MoffettNathanson principal and senior analyst Craig Moffett wrote he didn’t expect Freewheel to be “financially material for either Cablevision or the wireless industry. The concept, however, is a very big deal.”

Other companies have tried the WiFi-only route with little success, Moffett wrote. He added that Republic Wireless already offers a WiFi only product or $5 per month, using the same Moto G phone Freewheel does, but demand has been lukewarm. And last week, mobile phone company FreedomPop launched a new Wi-Fi-only plan which includes unlimited voice, text and data on nearly 10 million hotspots nationwide for only $5 per month.

“But there is something much bigger afoot here,” Moffett wrote. “Cablevision’s real game is almost certainly to use the new Freewheel service as a beta test for what will eventually be a WiFi-first, rather than WiFi-only, service. That’s the game changer we’ve been writing about for the past four years.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

WiFi-first, particularly when deployed by a cable operator with a much larger footprint than Cablevision’s 3-million subscriber New York metro area (like Comcast) could attract a lot of customers if priced and marketed aggressively, Moffett wrote.

“Coming on the heels of Google’s entry into the wireless business, and today’s disclosure that Google will indeed have least-cost dynamic routing that will play off WiFi, Sprint, and T-Mobile on a call-by-call and/or session-by-session basis (this had been the industry’s big fear when Google’s service was announced last week), Cablevision’s Freewheel is one more straw in the wind,” Moffett wrote. “The wireless business is in a tough spot.”

The Freewheel name also is similar to that of advertising technology company FreeWheel, which Comcast purchased last year. But sources familiar with both parties said Comcast and Cablevision have been working amicably toward an agreement that will allow both companies to thrive. Those sources added that because the two companies have different businesses -- just like Delta faucets and Delta Airlines -- there should be no problem in reaching a compromise.