Media Firms Look for Liquidity

Media companies are increasingly tapping debt markets for liquidity as the COVID-19 outbreak worsens, but analysts say those moves are prudent as companies try to keep the engines humming while riding out the coronavirus pandemic.

Adding more debt in an uncertain time can carry risks, though, especially if uncertainty lasts longer than expected. And it’s likely that the current trips to the debt trough will need to be repeated further on in the difficult business cycle.

In the past month, The Walt Disney Co. has completed two bond offerings (one in the U.S. and one in Canada) for about $7 billion, Comcast tapped the debt markets for about $4 billion and ViacomCBS finished a debt offering that raised about $2.5 billion. On March 31, Fox Corp. issued about $1.2 billion in bonds for general and corporate purposes. Several other smaller companies have issued debt and tapped into lines of credit to get the cash needed to run their businesses in these uncertain times.

Disney shut down its domestic theme parks and cruise line in March. Around that time, it halted distribution of its movies from its studios, and suspended TV and film content production. Disney’s broadcast and cable networks are feeling the pinch of delays in the regular seasons of four professional sports leagues: the National Basketball Association, the National Hockey League, Major League Baseball and Major League Soccer.

Theme Park Hit For Disney

MoffettNathanson media analyst Michael Nathanson estimated Disney could take a $3.4 billion revenue hit this fiscal year on theme parks alone, from the COVID-19 outbreak and the expected recession.

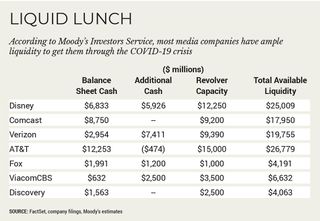

“Liquidity is pretty binary,” Moody’s Investors Service senior vice president Neil Begley said. “You either have it or you don’t.” And issuing debt mostly isn’t a big concern for large media companies needing that liquidity.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Disney, Begley said, is in a special situation because it already added a lot of debt last year to finance the $71.3 billion purchase of certain 20th Century Fox assets. He expects Disney to take six months to a year or longer to get back to its pre-acquisition leverage levels of about 2.5 times cash flow.

“Presumably, once we clear this, these companies will use whatever that cash is to pay down some debt,” Begley said. “We are not taking actions on companies because they are going to market and raising new capital.”

For Netflix, forcing consumers to stay at home has meant soaring usage and engagement. Deeper engagement from consumers could translate into fewer disconnects. It also could mean that, as viewing hours skyrocket, subscribers are running out of things to watch.

That’s a worry, given that Netflix has shifted from a reliance on library movies and TV episodes toward original content. According to researcher ReelGood, Netflix’s movie library has shrunk by about 40% since 2014 and its TV episode vault has decreased by about 25%. With production suspended on many original series from its own studios and others — including season 4 of Stranger Things, Grace and Frankie and others — Netflix could feel a strain if the stay home orders last longer than expected.

Content Crunch May Loom

Begley said nearly every programmer faces the dilemma of a shortage of new content. For the most part, programmers are relying on cash flows and existing lines of credit to lessen the blow from expected declines due to COVID-19.

Moody’s senior VP of media and telecommunications Jason Cuomo said in a recent report that he believes Discovery Inc. has at least a $1 billion cash-flow cushion to absorb business disruptions, assuming its debt remains level. On the liquidity side, Discovery is in good shape with $1.55 billion in cash at year-end 2019 and about $2 billion available under a $2.5 billion revolving credit facility.

But Discovery (and several other programmers) also withdrew prior 2020 financial guidance, based on the delay of the 2020 Summer Olympics.

“Anything that is in post production is probably worth its weight in gold,” Begley said. By late April or May, some distributors will start looking to replenish their coffers with movie and series content, he said.

The need to buy more content could force SVOD companies back to the debt markets. Fitch Ratings director Patrice Cucinello said in a research note that Netflix ended 2019 with about $5 billion in cash on the balance sheet and the content pipeline “is probably fine” for the next three to four months. Netflix, which last issued bonds in October, will likely have to return to the debt markets after the coronavirus crisis abates and it ramps up content production.