New Model Favors Distributors

As earnings season for content providers rapidly approaches — most are scheduled to release their quarterly financial results in the first two weeks of November — investors are increasingly wondering if programmers, who have for years exerted their dominance over distributors, are beginning to lose their grip.

Already, two high-profile carriage renewals are in the books — The Walt Disney Co.’s renewal with Altice USA in the New York market and Viacom’s carriage pact with the second largest cable operator in the country, Charter Communications.

Related: Viacom’s Schireson Says Charter Deal Could Be Blueprint

While most analysts had seen those two programmers as prime examples of how quickly the fortunes of once-dominant content providers could change — each were facing shrinking subscriber bases due to cord-cutting and skinny bundles — both were able to hammer out deals without going dark. That seemed especially surprising for Viacom, which already had seen its channels go dark on systems owned by Cable One and Suddenlink (since renewed). Viacom has struggled with ratings declines and was said to be ripe for getting dropped by Charter.

But instead of testing those waters, Charter, according to reports, agreed to carry eight Viacom channels on its most popular tiers, relegating the rest to pricier packages. And perhaps more importantly, Charter extracted a reduction in affiliate-fee pricing some analysts estimated could be between 10% and 15%. That could have been sweetener enough to discourage Charter from experimenting with dropping the channels.

Related: The Pendulum Swings Back

With the Charter deal, Viacom has basically completed the latest round of renewals — MoffettNathanson media analyst Michael Nathanson estimated that Verizon Communications, the National Cable Television Cooperative and one smaller operator are likely next on the renewal calendar for the programmer over the coming three years.

Distributors Gaining Ground

Pivotal Research Group senior research analyst- advertising Brian Wieser said that while it depends on the network, programmers are increasingly getting pushback on carriage of their least popular channels. And unlike in past years, the distributors appear to be gaining ground.

“The writing is on the wall,” Wieser said. “ ‘VH1 Classics for Women, Jazz Version’ as a digital network does not have a future.”

Wieser was joking, but the gist of what he said rings true. The current cast of cable networks was created during a period when distributors wanted more inventory to fill up their 150-plus channel lineups. Also at that time, consumers saw real value in larger channel offerings and were willing to pay for it. Today, less is more as consumers are seeking out smaller bundles of programming.

“I think the future is worse now than what everyone thought it would be a few years ago,” Wieser said.

That shift will likely translate into lower affiliate fee increases and carriage for fewer networks, he said.

“The Discoverys and Viacoms of the world will end up negotiating lower price increases and end up with lower carriage,” Wieser said. He added that fewer channels also means lower costs for the programmer, so they should “end up in the same place.”

Wieser is not alone. Credit Suisse media analyst Omar Sheikh estimated annual subscriber declines for major domestic cable networks of about 2%, while affiliate fee growth would fall from 9% in 2018 to 7% in 2019 and 5% by 2020.

The affiliate-fee erosion comes as the years-long ad market decline continues. In a note earlier this month, Nathanson estimated national TV ad growth will be -10%, with cable down 4% and broadcast down 19% (+1% ex-Olympics).

Wieser predicted a 2% decline in national television advertising, while Sheikh estimated that ad growth would shrink from 4.3% in 2018 to between 2.4% and 2.5% by 2019-20.

Some analysts have predicted that distributors could use this newfound clout to finally break the bundle, or at least cease carrying networks they no longer feel are worth the trouble, but Wieser doesn’t see that happening on a wide-scale basis yet. He pointed to the recent Charter-Viacom and Disney-Altice deals, which allowed the distributors some carriage flexibility.

No Wholesale Exodus

Sources familiar with the Altice-Disney deal have confirmed reports that Altice won’t carry ESPN Classic as part of its Disney deal, in return for raising the minimum carriage bar for its other networks.

Other analysts such as Sanford Bernstein’s Todd Juenger have worked out the math to justify dropping channels. But even Juenger, who has believed the content business has been in structural decline for years, doesn’t predict a wholesale exodus from ESPN, whether the math works or not.

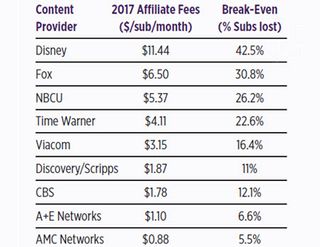

The economics look better as the fees increase. In a recent note Juenger estimated that dropping ESPN and its $11.44 per month per customer in affiliate fees would make sense even if Charter lost 42.5% of its customers. But he didn’t think any distributor was likely to drop bigger content owners.

“The problem, of course, is no [multichannel video programming distributor] wants to risk (yet) touching Disney (or Fox, Turner, CBS),” Juenger wrote. “Rightly or wrongly, the fear is that too many subscribers care too passionately about certain networks in those families.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.