News

Latest News

Paramount and Charter Agree To Extend Talks, Hold Off on the Ol' Blackout

By Daniel Frankel published

Paramount’s program licensing deal with the No. 1 pay TV operator in the U.S. is set to expire when the calendar turns to May

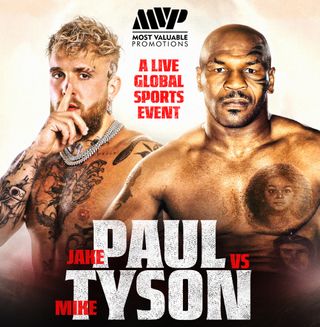

Mike Tyson-Jake Paul Bout Sanctioned as Professional Fight

By R. Thomas Umstead published

New York, Texas fight press conferences set for Netflix-distributed event

Kevin Hart, Kenan Thompson To Host Olympics Highlights Series on Peacock

By R. Thomas Umstead published

Eight-episode series to offer timely, comedic recaps of 2024 Paris Olympics events

Warner Bros. Stock Nears All-Time Low Following Report of Comcast's Aggressive NBA TV Rights Bid

By Daniel Frankel published

NBCU is reportedly nearing a deal to pay the league $2.5 billion a season

Samsung TV Plus Swings for the Fences With Streaming Sports Channels (NewFronts)

By Jon Lafayette published

Service tunes up with Warner Music deal

Oxygen’s ‘Snapped’ Celebrates 20th Anniversary With May Special

By R. Thomas Umstead published

True crime series drawing record viewers in 33rd season, says network

T-Mobile Dials Deeper Into Ad Business With Retail Network (NewFronts)

By Jon Lafayette published

Adds video inventory in deal to carry Plex

iSpot Named Preferred Measurement Firm by Roku (NewFronts)

By Jon Lafayette published

iSpot to integrate Roku watermark to validate ad inventory authenticity

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.