OTT Devices, Smartphones, STBs Gain Digital Steam

The Web browser continues to cede valuable ground to other digital platforms amid growing usage of OTT devices, smartphones, and even cable-supplied set-top boxes, FreeWheel, the Comcast-owned ad-tech company, found in its latest quarterly report.

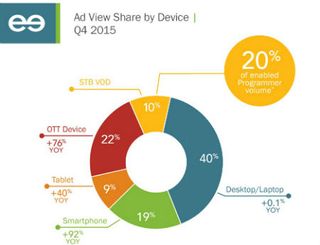

“Propelled by 76% growth across OTT (Roku, Apple TV, Chromecast, Gaming Consoles, and Smart TVs) and 92% on smartphone devices, as well as the inclusion of STB VOD, which amounted to 10% of total delivery, never again will the browser be the first stop for digital video content,” FreeWheel noted in its Q4 2015 Video Monetization Report.

.

With respect to ad views by device type, desktops/laptops still led all categories with 40% share, but was up only 0.1% year-over-year. OTT devices, meanwhile, scored a 22% share (up 76%), followed by smartphones (19%, up 92%), set-top VOD (10%), and tablets (9%, up 40%).

Among OTT devices, Apple TV held court with a 44% share of ad views, followed by Roku (34%), gaming consoles (15%), Google’s Chromecast adapter (5%), and smart TVs and the Amazon Fire TV (1% each).

FreeWheel’s study also offered an update on the momentum of authenticated TV Everywhere services.

Authenticated viewing for long-form and live content accounted for 65% of monetization in Q4 2015, up from 56% in the year-ago period.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“While we saw very strong progression in video ad views across authenticated content at 142% year-over-year, looking back at the previous four quarters of growth there is a notable decline across the top-line, especially when comparing to the staggering 591% rate we reported in Q4 2014,” FreeWheel said.

Entertainment content was top category for TVE with respect to video ad views, rising 202% year-on-year, followed by sports (46%, up 69%), news (6%, up 98%), and kids fare (5%, up 2,073%).

Among other findings, long-form on-demand and live streams were the fastest growing content areas – up 56% and 129% year-over-year, respectively. Authenticated ad views also accounted for more than 65% of all long-form and live programmer monetization, FreeWheel said.