Programmers Feel the Industry’s Pain

Look For Networks’ affiliate-fee and advertising revenue growth to slip in the third quarter, as declining cable video subscriber rolls and stiff competition from digital ad companies continues to weigh on the sector.

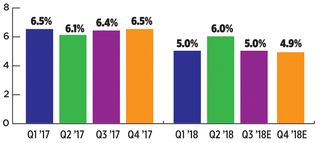

Cable subscribers have been declining at a 3%-3.5% clip over the past several quarters, and that is not expected to improve, according to UBS Securities media and telecom analyst John Hodulik. He estimated affiliate fee growth for ad-supported cable networks of 5% in Q3 (compared to 6% growth in Q2) and 4.9% in Q4 in a research note. He sees pay TV subscriber trends improving slightly in Q3, aided by virtual multichannel video programming distributors and over-the-top service providers. That won’t be enough to stop the decline in affiliate revenue.

Blame It on Fox

Hodulik blames the deceleration largely on 21st Century Fox, which he says is being compared against strong renewal-driven results from last year.

Hodulik estimates that Fox’s affiliate-fee growth will be stronger than average at 7% for the period, but down by about 400 basis points compared to last year. He expects Fox to return to form in calendar Q1, boosted by renewals with Altice USA and AT&T in Q4.

On the advertising front, Hodulik estimates that overall revenue will decline by 0.8% (compared to a 0.2% decline in Q2), as ratings continue to slip. Aggregate 18-49 year old viewership declined 10.8% in Q3, the worst quarterly decline in 10 years. But Hodulik said demand is strong and cited a improvement in National Football League game ratings — up 9% in Week 4 of the season and 3% season-to-date, compared to 7% decline at this point last year.

“The deceleration in advertising revenues is modest relative to the deterioration in ratings suggesting pricing is strengthening,” he wrote. “This is consistent with our channel checks, which continue to indicate demand for TV inventory is as high as it has ever been.”

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Analysts were even more optimistic about the prospects for the aftermath of the biggest programming M&A deal of the year, Disney’s $71.3 billion purchase of Fox programming assets, including FX, National Geographic Channel and production studios. Most analysts see the deal — expected to close as soon as the end of this year — benefiting both companies.

Barclay’s media analyst Kannan Venkateshwar raised his ratings for both Disney and Fox to “overweight,” acknowledging the irony of upgrading two stocks for opposite reasons: Disney for getting larger and Fox for getting smaller.

Here’s why: “While New Fox will be smaller in revenue terms, it will emerge as the biggest pure play for news and sports,” Venkateshwar said in a research note. “Disney, on the other hand, will emerge as the biggest for scripted content but its ability to monetize this is, at least at this point, more a hypothetical. Therefore, the real irony is that by shedding assets, New Fox in some ways will re-emerge stronger and more focused.”

Morgan Stanley media analyst Ben Swinburne expects stronger affiliate fee growth from New Fox — between 7% and 8% annualized growth through 2022 — especially as it moves through a new distribution renewal cycle over the next three years. Swinburne estimated that the New Fox networks will generate about $5 per month per customer from the pay TV bundle in fiscal 2019.

“Driving this higher during the upcoming renewal cycle is the key to top line growth,” he wrote.

Hodulik believes that ratings-challenged Viacom will report a 1% increase in affiliate fee revenue while domestic ad sales will dip 4.3%, to $896 million.

Positive on Discovery

Discovery, fresh off a handful of renewal deals with vMVPDS such as Hulu and Sling TV, is expected to have a strong Q3. Evercore ISI media analyst Vijay Jayant said in a research note that those agreements allow Discovery to focus on execution.

Jayant sees Discovery’s new distribution deals adding up to $50 million in high-margin affiliate revenue next year.

But that increase won’t likely be coming all from the Hulu deal. Sanford Bernstein media analyst Todd Juenger, citing an article in The Information, noted that while Hulu said it paid more overall, license fees for on-demand content have been reduced.

For Q3, Jayant expects U.S. Network revenue at Discovery to rise 2.2% to $1.6 billion, with domestic ad revenue rising 3.6%. International revenue should rise 3.6% to $969 million, with ad sales rising 3.4%.

Jayant was encouraged by improved ratings trends at Discovery networks — the group was up modestly in Live +3 in the 25-54 year old age demo — and a strong ad-sales upfront haul. He said all indications point to a successful upfront season after the Scripps Networks purchase, with average pricing increases of about 10% and only modestly lower inventory sold.

“Given this backdrop, we think there is upside to our advertising estimates, and for 3Q18 we estimate at least +3.5% growth,” Jayant wrote.