Comcast and Charter Should Let Verizon Build Small Cells on Their Networks: Analyst

Comcast and Charter Communications lose money on their fledgling mobile services based on MVNO deals with Verizon.

Verizon, meanwhile, faces massive buildout challenges in terms of making millimeter wave distribution of fixed 5G services a reality.

But what if the three companies truly worked together, beyond a mere MVNO leasing deal, and shared wireless infrastructure?

That is the scenario put forth in a paper published late last week by equity research company Moffett Nathanson. The analysts point to the model of Altice USA and Sprint, which they say have created an “elegant solution” for sharing network resources.

Within Altice’s northeast Optimum footprint, the cable operator is allowing Sprint to add strand-mounted small cells onto its fiber network. The wireless operator has a pathway to the densification it needs to make millimeter wave 5G a reality. Altice, meanwhile, can leverage a greater and greater share of small cells for free as the buildout continues, thus decreasing the MVNO cost of its wireless service over time.

The Challenges

Moffett Nathanson estimates that Comcast and Charter, which collaborate on their wireless services and have similar MVNO deals, pay around $5 to Verizon for every gigabyte a mobile customer uses on the Verizon wireless network. The cable companies thus lose money on every wireless subscription.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

While introducing their services, both cable companies touted the ability to offload usage to their own public Wi-Fi networks. But scheme hasn’t worked as planned. “Cable’s out-of-home Wi-Fi network is a bust,” Moffett Nathanson said. “The industry stopped expanding it years ago after it became clear that it was never going to provide a robust out-of-home user experience.”

Worse, it’s Verizon—and not Comcast or Charter—which determines when a customer switches from cellular to Wi-Fi. “Why would Verizon want to help Comcast and Charter divert money away from its own network?” the research firmed noted.

Meanwhile, as Moffett Nathanson pointed out in detail in an earlier report, Verizon—and the other three major U.S. wireless network operators—face a seemingly impossible task in creating enough small-cell density to achieve ubiquitous millimeter wave coverage of fixed 5G services.

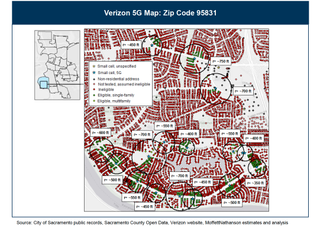

As the the company’s report on Verizon’s early deployment of fixed 5G services in Sacramento shows (see graphic below), “even a 100-fold improvement in their current coverage and penetration wouldn’t be enough to make their existing architecture economically interesting.”

Pondering the solutions to all of these problems associated with cable-wireless convergence, Moffett Nathanson doesn’t see M&A as a feasible path to circumventing arduous infrastructural buildout needs. Not only is it not enticing to the stakeholders, it would not be appealing to regulators, either.

So what of the idea that the companies working together on infrastructure? Well, it was the 2011 arrangement that led to Comcast and Charter’s current MVNO deal with Verizon that supplies the blueprint, the research company noted.

Under that deal, Comcast, Time Warner Cable and Bright House Networks entered into negotiations with Verizon over the sale of the cable consortium’s AWS-1 spectrum.

“What started as a simple spectrum sale ended with a strategic alliance that didn’t just create the cable MVNO we know today, it also envisioned a future where Verizon would resell cable broadband across their footprint (astonishingly, even in markets where Verizon was selling FiOS service). The latter initiative never fully materialized for a variety of reasons,” Moffett Nathanson wrote. “But the companies, even then, evidenced a clear understanding that they would be better off together than apart.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!