TV Girds for the Big Meltdown

Cord-Cutting right now is a little bit like the quickening threat of global warming. As increased temperatures melt away long-frozen Alpine tundra, for example, even more carbon dioxide is released into the atmosphere, further accelerating the phenomenon.

Here, we can equate the upcoming debuts of new streaming services from Disney and AT&T’s WarnerMedia unit as the melted tundra. These services, it’s believed, will meld with Netflix, Hulu, Amazon Prime Video and other subscription video-on-demand platforms to form a glut of over-the-top content that analyst Alan Wolk calls the “Flixpocalypse.”

This, he said, will further quicken a cord-cutting dynamic that has already reached a critical stage.

“We have predicted that cord-cutting — which, in 2018, represented 0.65% of all people giving up both MVPD [multichannel video programming distributor] and vMVPD services — may grow to as much as 6% to 8% a year once the actual Flixpocalypse happens and there are seven or eight major [SVOD] services,” Wolk, the lead analyst for TV[R]EV, said.

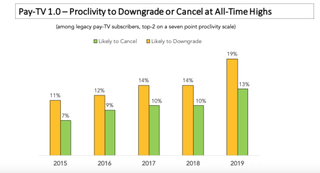

According to a survey conducted in May by another research company, The Diffusion Group, 13% of legacy pay TV subscribers are “moderately likely” or definitely planning to cancel service in the next six months.

“More and more consumers are on the edge of cutting the cord, and adding Disney+, in particular, could be the straw that breaks the camel’s back,” TDG president and co-founder Michael Greeson said.

Tipped Over the Edge?

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

The industry has been talking about cord-cutting for a decade now, but lately things seem to have reached a tipping point, even if media stocks’ performance this year doesn’t seem to reflect much concern.

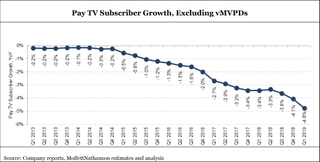

The U.S. pay TV industry lost more than 1 million subscribers in each of the last three quarters, shedding more than 1.4 million users during the first three months of this year, according to Kagan, a media research group within S&P Market Intelligence. According to MoffettNathanson, the combined video losses from cable, satellite and telco TV were more than 75% worse than the first quarter of 2018.

“With Q1 cord-cutting results now in the books, it may still be too early to abandon ship,” MoffettNathanson principal and senior research analyst Craig Moffett wrote in a May research note. “But it’s not too early to put on the life jackets.”

Indeed, while Moffett conceded that the subject of cord-cutting is “old news,” we do seem to have reached deep and uncharted waters.

No one thinks the pay TV ecosystem is going to disappear entirely. But we are looking at a near-term future in which the land surface covered by cable, satellite, telco and internet protocol-delivered pay TV services will be much smaller than it is even today.

The impact discussion used to focus on the cable providers, who, after all, got into business by providing subscription TV. But these companies have finally convinced their investors that their focus is on broadband connectivity.

Comcast, for example, lost another 120,000 video customers in the first quarter. But the No. 1 U.S. cable company saw its share price go up 19% in the first three months of 2019. Charter, which lost 145,000 video subscribers in Q1, saw its share price spike 12%. Same deal with Altice USA.

Meanwhile, virtual MVPD services, which had previously buffeted the subscriber losses from the linear side of the pay TV business, have stopped growing.

“There’s every reason to believe that things will only get worse,” Moffett noted. “If cable is, indeed, becoming less inclined to defend the status quo, then traditional MVPD losses will only accelerate. But if history is any guide, the response from the media companies will be to raise rates to pick up the slack. That will accelerate the declines.”

Media companies, which are most affected by cord-cutting, are also responding by deploying what Moffett refers to as the “lifeboats,” direct-to-consumer streaming services like Disney+ that are “ready and waiting if the status quo deteriorated to the point that it came time to abandon ship.”

Indeed, from the coming launch of subscription service Disney+ to Viacom’s $340 million purchase of ad-supported platform Pluto TV, the instinct of self-preservation among content creators is on full display as they look to a future in which pay TV media networks drive less and less revenue.

“Generally speaking, there will come a time when every TV network, big or small, will have to consider DTC [direct-to-consumer distribution] as a way to prop up declining pay-TV-related revenues,” Greeson said. “We’re seeing this already.”

Of course, as lifeboats go, some companies have the resources to build better ones than others. Disney started on its quest to build a three-headed OTT platform — underpinned by ESPN+, the upcoming $6.99-a-month Disney+ and Hulu — with its $1.58 billion purchase in 2017 of BAMTech, the acclaimed streaming technology shop founded by Major League Baseball.

Disney is better situated to self-distribute its content than any media conglomerate, thanks to the broad-reaching familiarity of its brands, Parks Associates senior research director and principal analyst Brett Sappington said. Key events along the way included paying $4 billion for Marvel Entertainment in 2009, $4.05 billion for Lucasfilm in 2012 and $71.3 billion for 21st Century Fox’s entertainment assets in March. Going back further, there was the $7.4 billion deal to acquire Pixar in 2006.

“We have a number of great creative engines across our company, all of which are dedicating their talent, focus and resources to develop and produce strong content for the Disney+ platform,” Disney chairman and CEO Bob Iger said, addressing investors in May.

In the buildup to launching Disney+, Iger suggested Disney would forgo $150 million in annual revenue that would have been recouped from other streaming services. Certainly, not every media company has the gusto to pass on $150 million.

All and all, “Disney has the ability to do things others can’t,” Sappington said.

For those who don’t consume a lot of live sports and news, Greeson said, “Disney+ will get them one step closer to a point at which they feel they’ve got enough services and content to cancel a $100-a-month cable service. We call this ‘the point of sufficiency’ and we’ve yet to hit it, though no doubt the new services will get us closer to this point.”

Longer term, Disney+ will pose an even greater threat to the current pay TV ecosystem if and when Disney bundles in the vMVPD Hulu with Live TV, Greeson added.

Disney, Moffett noted, “uniquely” has the assets to succeed in a world in which pay TV is winnowed down to skinny bundles built around sports and news, while entertainment gets shifted off to self-distributed streaming platforms. “But does anybody else?”

Analysts don’t see AT&T’s upcoming SVOD launch, built around its recently acquired WarnerMedia assets, as immediately impactful to the pay TV ecosystem.

“No doubt a $17-a-month bundle of HBO (which costs $15 a month in most other places) plus Cinemax (another $10 a month or more) plus Warner Bros. movies and shows will appeal to many premium consumers, but it will most likely lead to more cord shaving of premium cable networks than it will cord-cutting,” Greeson said.

Still Just Complementary?

So far, media companies have been careful to describe their newly founded or acquired OTT assets as mere hedges against the global power of Netflix, and not as alternatives to a fast-declining pay TV ecosystem.

Amy Kuessner, senior vice president of content partnerships for Pluto TV, which Viacom bought in January, said the AVOD platform represents a “billion dollar” opportunity for the MTV Networks parent. “But I can assure you that it won’t be at the expense of MVPD relationships,” she said. “We see Pluto as a complementary offering.”

With Pluto TV now reaching 16 million regular viewers a month and using a linear program guide-like interface that’s familiar to longtime pay TV consumers, the media conglomerate recently launched limited, on-demand versions of major network brands like Nickelodeon, MTV and Comedy Central on the platform.

Viacom has also taken the first steps to expand Pluto TV internationally, launching versions of the platform in the United Kingdom, Germany and Austria on Amazon Fire TV.

“I think with what we have seen with Viacom is going to become more common,” Sappington said. “They’ve winnowed down their brands and channels to around five major brands.” Viacom achieves scale for these brands through Pluto TV’s reach — scale needed to monetize the offerings through the media company’s fast-evolving advanced advertising wherewithal.

With Viacom currently earning around $2.5 million in “media network” revenue each quarter from operator affiliate fees and linear TV advertising, the conglomerate faces a future in which it must increasingly replace that revenue purely through OTT advertising.

“If pay TV continues its decline — whether or not it is driven specifically by the addition of Disney+ or WarnerMedia — operators will look to cut back on their content expenses and are likely to drop less popular networks,” Greeson said.

“Generally speaking, there will come a time when every TV network, big or small, will have to consider DTC as a way to prop up declining pay-TV-related revenues,” he added. “We’re seeing this already.”

With nearly 90 million U.S. homes still subscribing to linear pay TV, it isn’t going away anytime soon, Sappington noted. But shrinkage is occurring to a point that “you’re going to have to have some measure of self-distribution just to be able to survive.”

Disney and WarnerMedia have the resources and brand power to build such a DTC asset from scratch. And Viacom had the wherewithal to purchase one with scale right out of the box.

What About Everyone Else?

But what about smaller media companies? What do they do for a lifeboat?

“Smaller networks are pretty much screwed unless they have a strong brand image and strong fan base that will pay cash money to watch them,” Wolk said. “They will have to sell themselves or strike a distribution deal with one of the Flixes to survive,” referring to the major SVOD services.

Some network brands currently on the pay TV grid will revert to “production company mode,” Wolk said, cranking out “five to 15 hours of original content a week that can be distributed via VOD on the various Flixes or MVPDs.”

Sappington sees a future in which smaller media companies partner up, rolling their various brands into a joint venture not too dissimilar to the way Hulu was founded 12 years ago.

In predicting the erosion of the pay TV ecosystem, it’s important to impart some sense of time scale — we’re merely at a point where media conglomerates are starting to make some moves, portending a future in which cable, satellite, telco and vMVPD services are still around, but no longer a central focus of distribution.

We’ve finally reached a point where we can glimpse at that future. We’re not actually there yet. Cord-cutting hasn’t killed the pay TV business, but it’s no longer an abstraction. And we’re beginning to see the beginnings of an aftermath.

“None of this is happening in the next two to three years,” Wolk noted. “Five to seven years is more like it.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!