What’s the Long Game on Video Shorts?

In the race to appeal to younger viewers, traditional content companies are increasingly turning toward short-form video and digital content providers, with several deals on the books over the past 12 months and more likely to come.

The latest to go short is Time Warner Inc.’s CNN, which paid about $25 million for online video company Beme, home of YouTube star Casey Neistat. As part of the deal, Beme’s 11-member staff, including Neistat — who has some 5.8 million YouTube followers — will join the news network and start a new media brand focused on millennial viewers.

Other companies have dipped their toes in the digital waters to varying degrees, ranging from NBCUniversal, which has spent about $600 million in online media sites BuzzFeed and Vox Media over the past 18 months, to 21st Century Fox, which in September paid about $6.5 million for a stake in DriveTribe, a new online motoring venture from former Top Gear stars Jeremy Clarkson, James May and Richard Hammond.

Earlier last month, Discovery Communications said it would invest about $100 million for a 35% stake in a new digital venture called Group Nine Media that would combine its science site, Seeker.com, and Sourcefed Studios production arm with pop culture site Thrillist, news site Now This and animal advocacy site The Dodo.

EXPERIMENT TIME

“Everyone is trying to figure out what the right format is,” Telsey Advisory Group media analyst Tom Eagan said in an interview. “There is going to be a lot of experimentation.”

Programmers have been trying to attract young viewers since the beginning of television. But as more and more content is available on more and more devices, snagging the coveted millennial audience means the delivery mechanism is almost as important as what is being delivered.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“What has been tried is to take a regular cable or broadcast linear service and try to make it fit,” Eagan said. “That doesn’t always work, whether it’s on a mobile device or some other device. I think they realize they not only have to change the content, but the format.”

In a recent interview, Discovery chief commercial officer Paul Guyardo called the Group Nine investment part of the programmer’s three-pronged strategy, consisting of its full product bundle, its participation in skinny bundles for more price-sensitive consumers and the creation of short-form video and content partnership Group Nine, which is aimed squarely at younger viewers.

“That’s an ad-supported model that does rely primarily on short-form [video], because that’s how millennials want to consume their content — it’s all about highlights and sound bites and snippets,” Guyardo told Multichannel News. “If you look at the way we’re building it, we’re building it in a very Discovery-esque way.”

Like Discovery, each programmer seems to be forging its own path with digital investments. At NBCUniversal, the BuzzFeed and Vox Media deals seemed to be more geared to enhancing its social media and digital advertising strengths. BuzzFeed reaches more than 500 million people per day on its various platforms, more than any other pure digital media company, and has a strong presence on social media sites like Facebook. Vox Media, which has eight separate brands including news site Recode, sports site SB Nation and the food-centric Eater, has about 170 million unique monthly visitors and 800 million total monthly content views (on- and off-platform), and two of every three of its users are on mobile devices, according to the company.

Pivotal Research Group senior research analyst Brian Wieser said practically every programmer is looking to secure a digital business, and buying established providers is frequently the quickest path to success. There are many reasons to take the digital plunge, he said.

HEDGING BETS

“Some of it is hedge,” Wieser said. “In the event alternate forms of content packaging become more common, someone knows what they’re doing. Some of it is for show to Wall Street and other constituents, just to say that ‘we’re doing this too.’ And there also can be the belief that combining small entities into larger ones, and you can build an even bigger business.”

Another reason could be a desire to align with a particularly strong management team. That’s what Wieser believes was a big driver for Disney’s 2014 investment in Vice Media, then a fledgling Canadian publisher and multimedia company with a brash CEO in Shane Smith who wanted an inroad into more traditional media. With Disney’s initial $200 million investment (it invested another $200 million later that same year), Vice announced it would take over A+E Networks’ H2 channel, rebranded as Viceland. A+E Networks, which itself owns about 15% of Vice Media, is jointly controlled by Disney and Hearst.

While sluggish early ratings put a bit of a damper on the initial enthusiasm for the channel, it has been attracting young men with shows like the self-explanatory Weediquette and skateboarding reality-competition series King of the Road. In November the channel said it would launch four new shows aimed at that demographic in the next two months — Payday, which follows the lives of four 20-somethings over the course of a single pay period; Big Night Out, which showcases how millennials party around the world, and Bong Appétit, which follows cooks who create high-end, cannabis-infused foods.

“Everyone wants a piece of Shane Smith’s pixie dust,” Wieser said.

MORE MOVES SEEN

The analyst added that he expects more deals to be done, but to what extent will depend on each individual company. At Fox, which in the past has leaned more toward developing new properties internally, Wieser believes that practice will continue.

Time Warner and NBCU are expected to continue on their previous path of making small venture investments in digital companies, he added.

“Do we expect to see more [deals]? Sure. I don’t see why not,” Wieser said. “You can argue that most companies don’t need to hurry because it just doesn’t change that quickly. But the perceptions of change are often greater than the reality.”

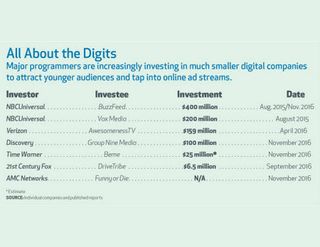

SIDEBAR: All About the Digits

Major programmers are increasingly investing in much smaller digital companies to attract younger audiences and tap into online ad streams.

InvestorInvesteeInvestmentDate

NBCUniversal . . . . . . . . . . . BuzzFeed . . . . . . . . . . . . $400 million . . . . . . Aug. 2015/Nov. 2016

NBCUniversal . . . . . . . . . . . Vox Media . . . . . . . . . . . .$200 million . . . . . . . August 2015

Verizon . . . . . . . . . . . .. . AwesomenessTV . . . . . . . . $159 million . . . . . . . . April 2016

Discovery . . . . . . . . . . . Group Nine Media . . .. . . . . . $100 million . . . . . . . November 2016

Time Warner . . . . . . . . . . . . . Beme . . . . . . . . . . . . . $25 million* . . . . . . . . . November 2016

21st Century Fox . . . . . . . .DriveTribe . . . . . . . . . . . $6.5 million . . . . . . . .September 2016

AMC Networks . . . . . . . . Funny or Die . . . . . . . . . . . . N/A . . . . . . . . . . . November 2016

* Estimate

SOURCE : Individual companies and published reports